AAVE, Compound, and JustLend are all DeFi borrowing/lending protocols. Of the three, AAVE is the most popular.

Written by: Mike Martin | Updated August 9 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Various decentralized finance (DeFi) lending protocols have established themselves in the crypto space in recent years. In this article, we’ll take a detailed look at three of today’s biggest DeFi lending platforms: AAVE, JustLend, and Compound Finance.

🍒 tasty takeaways

Even if you’re not well-versed in cryptocurrency, financial theory suggests that established digital assets like bitcoin and ether should be part of your investment portfolio due to their low correlation to traditional assets.

Interestingly, if you’re invested in a 401k, you might already have indirect exposure to cryptocurrencies.

Besides holding crypto, you can aim for higher returns by participating in DeFi activities, such as lending, liquid staking, and yield farming.

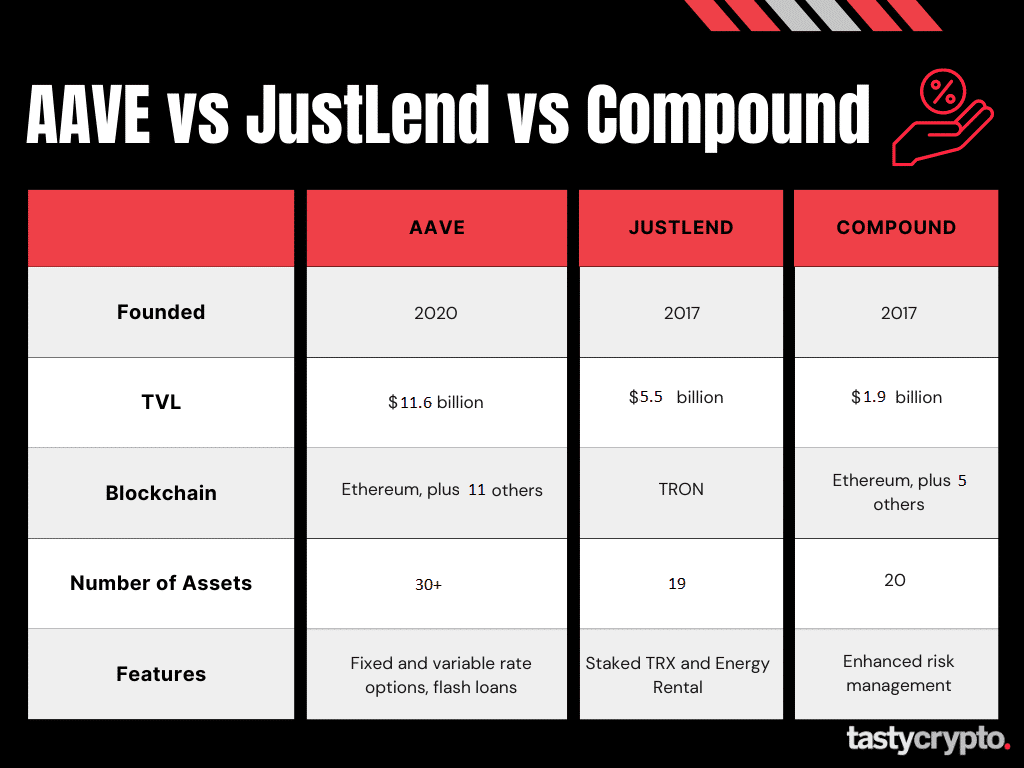

Let’s first explore a visual comparing our three protocols, and then continue by explaining what DeFi, or decentralized finance, lending is all about.

What is DeFi Lending in Crypto?

Simply said, DeFi lending enables anyone to borrow or lend money on a blockchain. A key difference between traditional lending and DeFi lending is that traditional banking involves lengthy and arduous checks to verify customer information.

DeFi, on the other hand, uses blockchain technology, decentralized applications (dApps), and smart contracts to issue loans much faster (provided the user meets the collateral requirements). Smart contracts handle most of the verification process, making it easier for both the lender and the borrower.

Overcollateralization ratios are used in DeFi lending to ensure that loans maintain sufficient collateral and do not become undercollateralized.

Additionally, on DeFi platforms, lenders usually can expect significantly higher returns, and borrowers can also get more favorable interest rates compared to traditional financial markets.

If you want to take an in-depth look at the technology, use cases, and advantages of DeFi lending, make sure to check out our linked guide.

Top DeFi Lending Platforms

According to DeFiLlama, the current top 3 DeFi lending protocols by total value locked (TVL) are:

AAVE: $11.6b

JustLend: $5.5b

Compound Finance: $1.9b

Let’s take a closer look at these three protocols below.

What is AAVE?

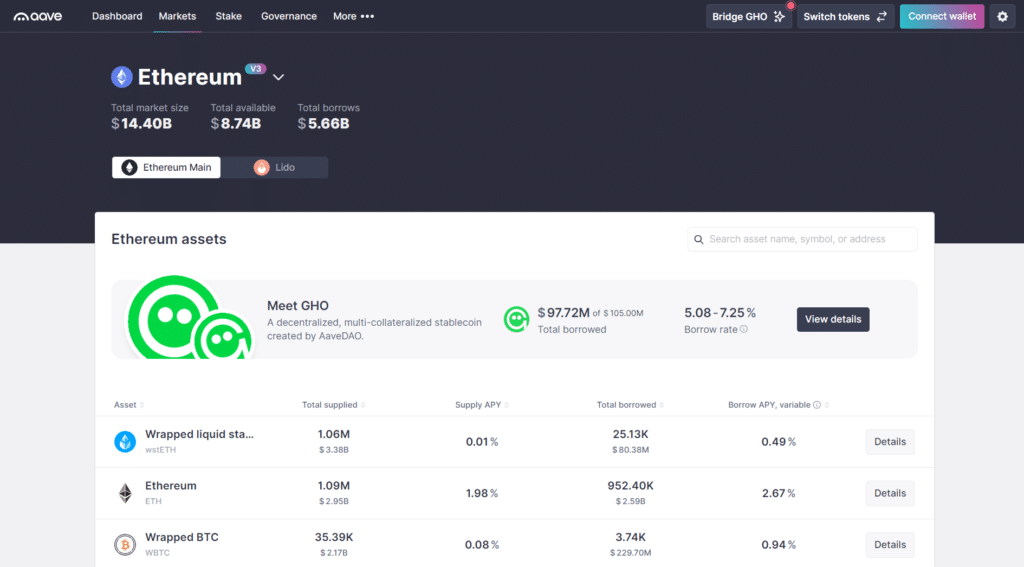

First going live on the Ethereum blockchain in January 2020, AAVE is a decentralized peer-to-peer borrowing and lending protocol.

Currently, there are 12 markets (chains) in AAVE’s ecosystem, which also includes a permissioned DeFi market for institutions. Users can lend and borrow 30+ different digital assets without having to meet know-your-customer (KYC) and anti-money-laundering (AML) requirements.

The protocol’s latest version (AAVE V3) aims for more capital efficiency while introducing cross-chain capability and increased security. AAVE V3 features sophisticated risk parameters such as: supply and borrow caps, isolation mode which limits an asset only to borrow isolated stablecoins while useing a single asset as collateral, and siloed mode in which assets with potentially flawed oracles can be separated.

Other special features offered by AAVE include:

Borrowers can choose between a fixed rate and variable rate.

Users with technical knowledge can make flash loans without collateral.

AAVE’s current borrow APYs are between 0.07% (MKR) and 22.4% (crvUSD) with an average of 4.2%.

AAVE Token

$AAVE token is the protocol’s governance token which can be used to vote on improvement proposals. The token can also be staked within the protocol where stakers can earn rewards and fees. The total supply of the $AAVE is hard capped at 16 million with a circulating supply of 14.9 million.

AAVE Security

AAVE protocol code is public and open-source. AAVE V3 has been audited by six different third-party security auditors with the last audit being undertaken by the end of 2022. It also offers a bug-bounty program to enhance its security.

What is JustLend?

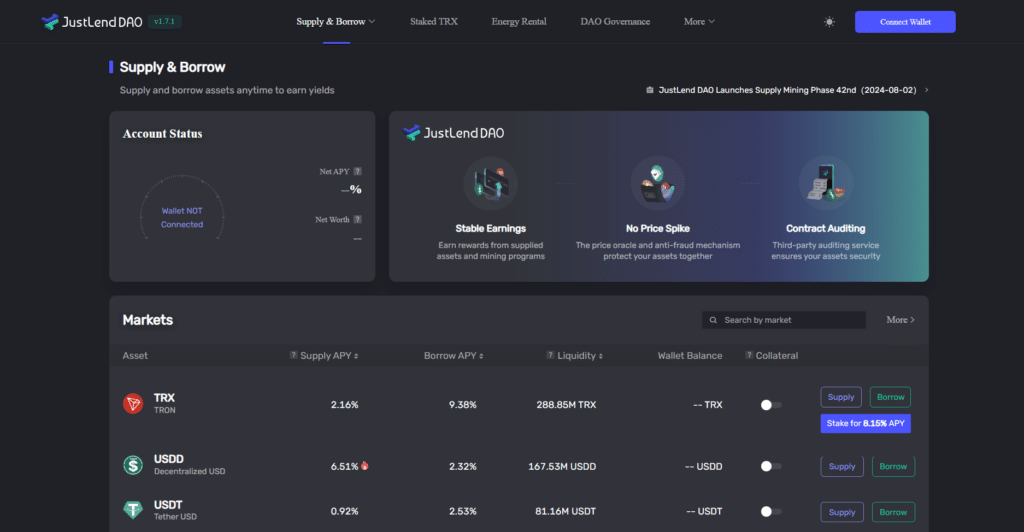

JustLend is a decentralized financial platform that enables users to generate returns by supplying assets, obtain digital assets by providing collateral, and engage in TRX staking on the TRON blockchain.

JustLend offers 19 different assets for borrowing and lending.

JustLend does not have a governance token. Because it runs on the TRON network, when funds are transferred, bandwidth and energy are consumed. Some bandwidth is given to each TRON account for free every day. Users can also get more bandwidth and energy by burning or staking TRX.

This April, the JustLend DAO had a major upgrade and now offers users two new features:

Staked TRX: participants stake their TRX token to receive sTRX token and earn higher yields.

Energy Rental: allows users to rent Energy or end their rental anytime they want. This is a more cost-efficient way to obtain Energy than the traditional way, where users stake or burn TRX to earn Energy, which is used to make transactions on the JustLend protocol.

JustLend’s current borrow APYs range from 0.94% (wstUSD) to 18.56% (SUN) while averaging 3.38%.

JST Token

The JST token underpins JustLend’s decentralized organization, playing a key role in decision-making and governance. This token facilitates voting as well as proposal submission. The market cap of JST is currently $266 million.

JustLend Security

This protocol is open sourced and was audited by Certik in 2022. JustLend also offers a bug bounty program.

📚 Want to research crypto on our own? Check out our free crypto research guide!

What is Compound Finance?

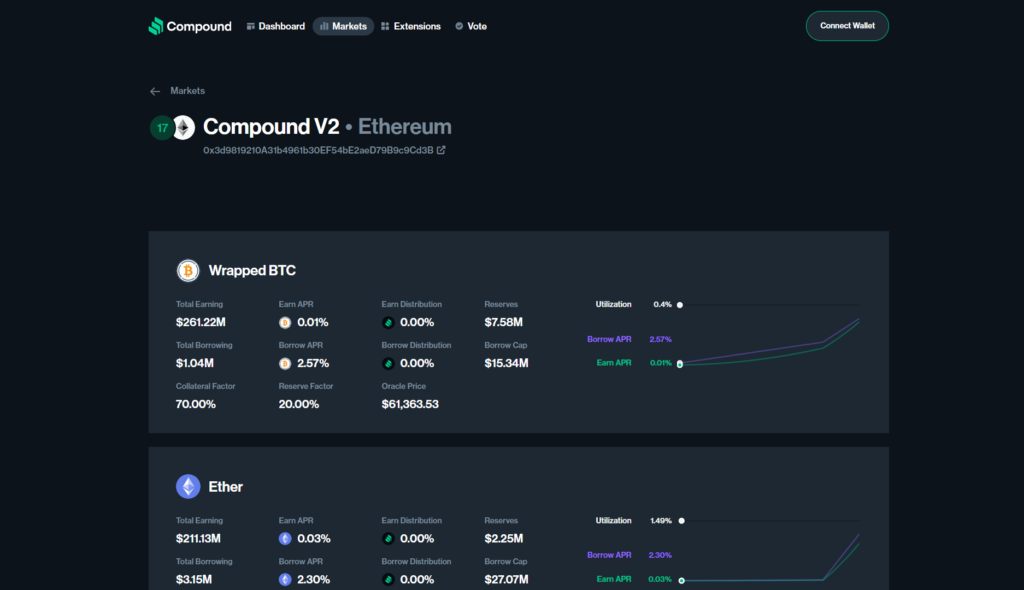

Compound Finance was founded in 2017. The Compound protocol was initially built on the Ethereum network and has extended to other chains. It allows users to collateralize their crypto assets to borrow the base asset such as USDC through smart contracts.

Suppliers of the base asset can earn interest by depositing their cryptocurrency. Compound Finance operates in a decentralized way and the protocol is EVM-compatible. It currently has 5 markets that feature 20 different assets for borrowing and lending.

The latest version of the protocol, Compound III, brought a number of improvements: the risk management and the liquidation engine have been completely revised to make them safer and more user-friendly; the size of individual collateral assets was limited to decrease risk; governance is easy to manage and has full control over economic policy.

Compound Finance’s current borrow APYs range from 2.30% (ETH) to 6.17% (SAI) and average 3.42%.

COMP Token

Compound Finance used to be a very centralized DeFi protocol. With the release of its $COMP token the platform takes a step towards more decentralization. $COMP is an ERC-20 token used for governance. Token holders have the right to debate, propose and vote on changes to the protocol, or delegate someone to do these on their behalf. $COMP has a hard-capped supply of 10 million, with about 8.3 million tokens currently in circulation.

Compound Security

Compound Finance has gone through a series of security audits by third-party auditors since its launch. The latest version (Compound III) has been audited by OpenZeppelin and ChainSecurity in 2022. A bug bounty is offered to users who report undiscovered security vulnerabilities.

Read Next

FAQs

AAVE, JustLend, and Compound Finance are pretty comparable in their functionality, although there are a few differences in the features offered. Each of the protocols has its own strengths:

Compound Finance supports the most assets.

JustLend currently provides the highest average borrow APYs.

AAVE has the most comprehensive security audits.

However, AAVE is active on 11 blockchains, Compound is running on 6 blockchains, whereas JustLand is only on TRON blockchain, this gives the former two more presence, thus more users. While Ethereum remains the largest blockchain platform with the most users, AAVE and Compound certainly benefit from the Ethereum ecosystem.

Like all crypto services, DeFi lending comes with its own set of risks. These are:

The codes and smart contracts used may have errors. In addition, the protocols are a popular target for hackers. In the worst case, this can result in the loss of assets.

The inherent volatility of cryptocurrencies poses another risk, especially for lenders.

Aave is larger than Compund in regards to total value locked. Additionally, Aave allows for flash loans while Compound does not.

Siyu Ren Heinrich

5 years of experience in crypto research of writing practical blockchain and crypto analysis on Medium.

MSc in Computer Science, BSc in Smart Engineering, and BSc in Economics and Statistics.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences