📕 Definition: A blockchain represents a digital ledger this is public, decentralized, and very difficult to tamper with.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

Without blockchain technology, popular cryptocurrencies like bitcoin, ether and litecoin would not exist. It is therefore vital to have a core understanding of this foundational technology before mastering cryptocurrency.

In this article, we will teach you what blockchain is, show you how it works, and explain how cryptocurrencies come into existence.

🍒 tasty takeaways

- Blockchain is a decentralized ledger for transactions.

- It ensures security, transparency, and immutability.

- Public blockchains are open to all, while private ones are controlled.

- Consensus mechanisms validate transactions in cryptocurrencies.

- NFTs represent unique digital assets on blockchains.

Blockchain Explained Simply

At its core, a blockchain is a ledger. A ledger simply represents a collection of transactions that have been verified and recorded. That’s all a blockchain is – a digital ledger that is distributed across all participants in a network.

A traditional (non-blockchain) ledger has many vulnerabilities. Usually, only a handful of people have access to these ledgers. This centralization of power can lead to ledgers being damaged, lost, and manipulated.

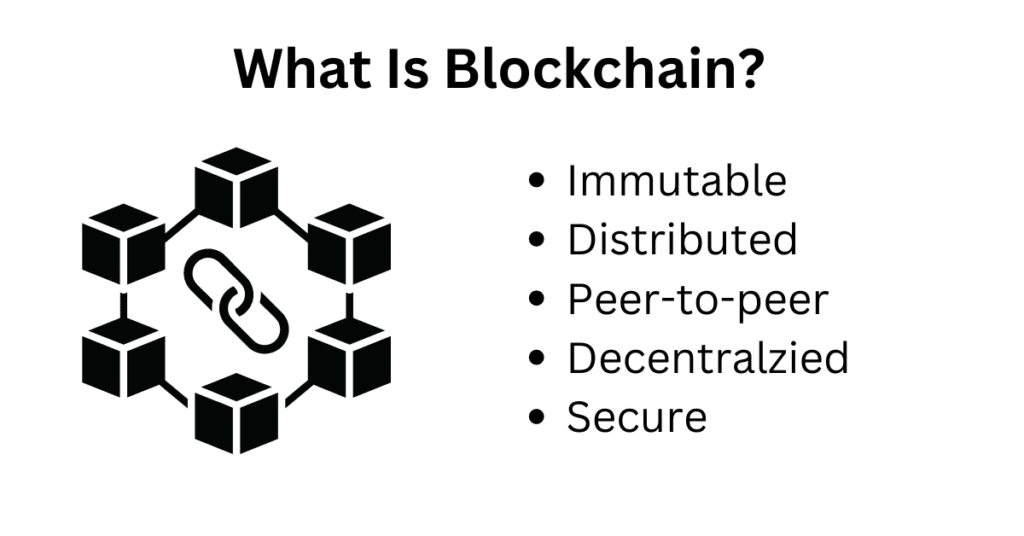

Distributed ledger technology, aka ‘blockchain’, solves all of the problems of traditional ledgers in 5 big ways:

Blockchain Is Immutable

Unlike a traditional ledger, blockchain ledgers are immutable. Immutable simple means set in stone. Once a transaction gets put in a block, and that new block is added to the blockchain, it is impossible to change the details of that transaction.

In blockchain technology, ‘cooking the book’ is impossible. Even if you tried to, a blockchain community would see your attempt and stop it. This leads us to our next distinguishing feature of blockchain technology.

Blockchain Is Public

Although both private and public blockchains exist, all of the blockchain networks you have heard of (e.g., Bitcoin and Ethereum) are public blockchains. Every single transaction that has ever occurred on a public blockchain is made available to the public to view. This means that anyone in the world can audit the transactional history of any public blockchain.

Block explorers like Blockchain.com and Etherscan allow anyone in the world to look up blockchain addresses and see every single transaction that that address was involved with.

Blockchain is Decentralized

In centralized systems, a small group of people supervise and make decisions about the current and future state of an organization.

In decentralized blockchains like Bitcoin and Ethereum, that control is delegated to all participants within the network. In public blockchains, all users, collectively, have a say on the state of the network.

This means that blockchain participants do not have to trust one another in order for a network to be a success – every participant has a copy of the distributed ledger, and every participant has a say on the state of the network. This leads us to our next characteristic of blockchain: peer-to-peer.

Blockchain is Peer-to-Peer

In public blockchains, peer-to-peer refers to a network of interconnected computers (nodes) that all have access to the same distributed ledger devoid of a central authority.

This democratization of power helps to create a trustless system.

This concept of peer-to-peer is so integral to both blockchain and cryptocurrency that Satoshi Nakamoto, the inventor of Bitcoin, named his white paper, “Bitcoin: A Peer-to-Peer Electronic Cash System.”

Blockchain is Secure

When compared to traditional ledgers, blockchain introduces unparalleled security. We already mentioned that blockchains are immutable – once a transaction enters a block, and that block gets added to the blockchain, it can not be changed.

On top of this immutability, blockchain includes a ‘consensus mechanism’. Consensus simply means that a majority of the peers on a blockchain network must reach an agreement on the state of the network before a new block is added. They accomplish this by determining which transactions are valid and invalid within a block.

In the following sections, we will explore consensus in more detail.

How Blockchain Works in 7 Steps

In this section, we will walk you through placing a cryptocurrency transaction in the Bitcoin blockchain to show you what happens behind the scenes.

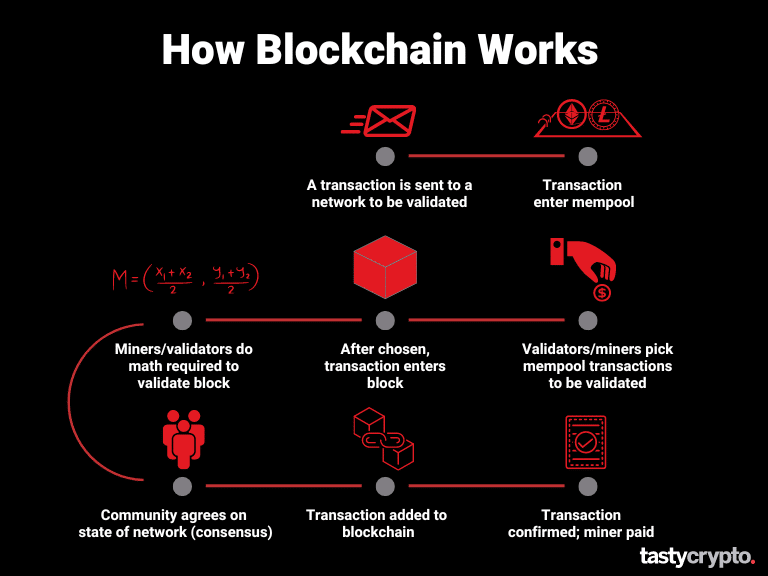

1. A Bitcoin Transaction Is Placed

The first step in a bitcoin transaction is the placement of a trade from a crypto wallet. There are both custodial and non-custodial crypto wallets.

Whenever you place a crypto trade, you must attach a fee to it. As we will see later on, you must pay a miner (or a validator) a fee to validate your transaction so it can be added to a blockchain. Currently, this fee is about $1.44 for a Bitcoin transaction, regardless of your transaction size.

2. The Transaction Enters The Mempool

Crypto transactions are not settled immediately; they must first be confirmed. The first step in the confirmation process is a ‘mempool’, which is essentially a waiting area for crypto transactions.

3. The Transaction Enters a ‘Block’

As long as you attached a fee to your bitcoin transaction, a ‘miner’ (or ‘validator’ for Ethereum), will pull your transaction from the mempool and put it in a block. Miners then proceed to validate all transactions within this block by using algorithms to solve a complex mathematical problem. There will be only one winning miner per block.

Watch: The Cost Of Mining Bitcoin

4. The Order Is Verified

After a block is validated (and the mathematical problem is solved), the block and its transactions are broadcasted to the entire Bitcoin network. The nodes within the network then make sure that none of the crypto within these transactions has already been spent (double-spending problem)..

5. Block Added To The Chain

After all transactions are validated and verified, that block then gets added to the blockchain.

6. The Miner is Paid

The winning miner then collects all of the fees that were attached to the transactions within the block as payment. A network may also pay additional rewards on top of these fees. Currently, the Bitcoin network rewards miners with 6.25 bitcoin (BTC) as payment for their services.

7. Transaction Settled

The bitcoin transaction is now settled. The block is timestamped and linked to the previous block. However, a few additional blocks must be added to the blockchain before the transactions in a block are confirmed. Confirmation can take from a few minutes to an hour.

What Are the Different Types of Blockchains?

There are four primary types of blockchains. The most common type is a ‘public’ blockchain. All popular blockchains, such as Bitcoin, Ethereum, Solana, and Litecoin, are public blockchains.

1. Public Blockchain

Public blockchains are open to anyone. These permissionless decentralized networks use consensus mechanisms such as “proof-of-work” (Bitcoin) and “proof-of-stake” (Ethereum) to reach an agreement on the current state of the network. This is also the process by which cryptocurrencies are created (more on this later).

2. Private Blockchain

Private blockchains are controlled by a central authority. Permission is required in private blockchains to both place transactions and validate transactions. Because of the limited number of participants, private blockchains are vulnerable to bad actors.

3. Consortium Blockchains

Consortium blockchains are like private blockchains in that they are centralized, but the control of these blockchains is diversified across numerous organizations. Private blockchains involve only one organization. Like private blockchains, parties must be invited to join consortium blockchains. Consortium blockchains are, therefore, both private and permissioned blockchains.

4. Hybrid Blockchains

Hybrid blockchains combine elements of both public and private blockchains. They are like private blockchains in that they are controlled by a single entity and require permission. However, the validation of the blocks is performed by a public-facing interface. Hybrid blockchain solutions are a favorite of organizations such as IBM, who have launched the popular IBM’s Food Trust Blockchain.

Additional use cases of hybrid blockchains (among others) can be seen in the healthcare sector. Here, blockchains provide an efficient and effective means of patient record-keeping and managing medicine supply chains.

What Is Cryptocurrency and How Does It Work?

Cryptocurrencies are digital currencies that are stored and validated on a decentralized, peer-to-peer network. For this reason, cryptocurrencies exist without the need for an intermediary, such as a bank.

Cryptocurrencies use cryptography (encryption algorithms) to secure transactions within a network. The use of cryptography makes it difficult to double-spend crypto, a major problem that plagued digital assets before Bitcoin was invented.

How Are Cryptocurrencies Created?

The origin of all cryptocurrency can be traced back to a consensus mechanism. As we learned before, a consensus mechanism is simply the method by which a group of blockchain participants comes to an agreement on the state of a network.

There are two predominant consensus mechanisms: proof-of-work and proof-of-stake.

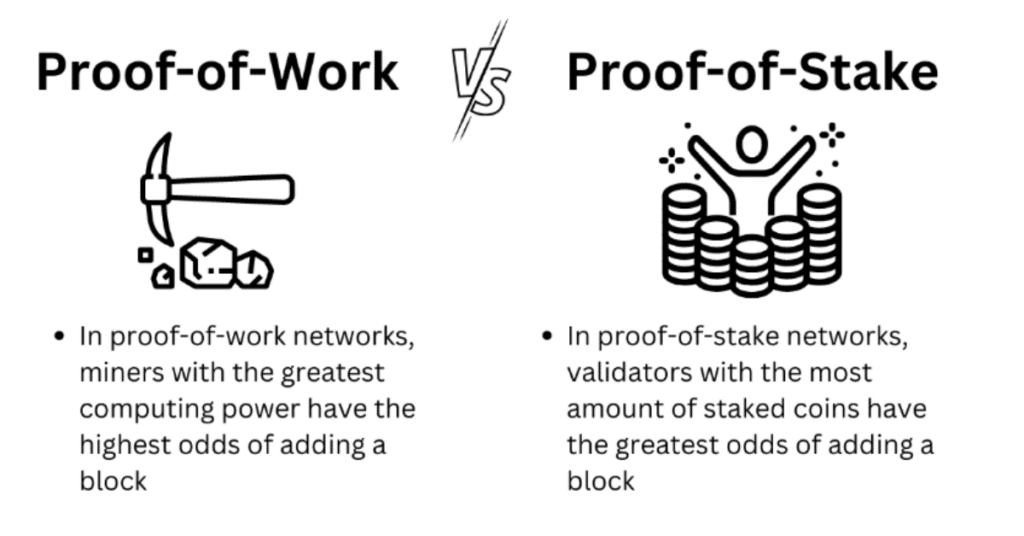

Proof-of-Work Explained

In proof-of-work blockchain networks, like Bitcoin, miners race to add a block to a blockchain by attempting to solve a cryptographic puzzle by employing algorithms. The miner that solves this complex math riddle first gets the honor of adding the next block to the blockchain.

For their work, a miner is rewarded by collecting the transaction fees in the block as well as an additional network reward. Currently, the block reward for Bitcoin is 6.25 bitcoin (BTC).

Massive computing power is necessary to compete in this space.

In proof-of-work networks, this consensus mechanism is the origin of all of a network’s coins. From this origin, the coins get bought and sold on both centralized and decentralized exchanges (DEXs).

Proof-of-Stake Explained

In proof-of-stake blockchains, like Ethereum, a network randomly selects a node (computer) to do the math required to validate transactions and add the block that those transactions reside in onto the blockchain.

In proof-of-stake, these participants are called validators. Validators ‘stake’ crypto coins to a network. The network selects a staked coin at random and does the math required on this stakers computer to secure and advance the network. The more coins a validator stakes, the greater the odds that validator has of being chose to validate.

Proof-of-stake coins are created through this consensus mechanism as well. However, after enough coins are given out to validators, proof-of-stake networks can choose to stop minting new coins and simply pay validators in transaction fees. This helps to control a networks supply of coins (monetary policy).

Bitcoin vs Ethereum: What’s The Difference?

We mentioned before that the Bitcoin network uses a proof-of-work consensus mechanism while Ethereum uses a proof-of-stake consensus mechanism.

Aside from this differentiator, these two networks diverge in what their blockchains can actually store.

The Bitcoin network can store only simple transactions, such as the buying and selling of BTC, in its blocks.

The Ethereum network can store both transactions and run code. This code comes in the form of programs called smart contracts.

⚠️ Ethereum recently switched from a proof-of-work to a proof-of-stake network. Read about the ‘Merge’ here.

What Are Smart Contracts?

Smart contracts are used to execute agreements between parties automatically, with no intermediary required. Smart contracts can be thought of as vending machines in terms of simple inputs and output: when you put a dollar in a vending machine, you get a bag of chips. Smart contracts use the same logic. No third party is required. Like all things in blockchain, smart contracts are immutable.

Smart contracts are the lifeblood of Web3. In this latest interation of the internet, versions of popular social media apps, and even entire financial institutions, are becoming rebuilt on decentralized blockchain applications. DeFi (decentralized finance) is the term used to describe blockchain’s growing presence in traditionally centralized financial services.

📕 Read! What is DeFi And How Does it Work?

What Are NFTs?

Most cryptocurrency is fungible. Fungible simply means interchangeable. For example, US dollars are fungible because any one US dollar is as good as the next. Bitcoins too are fungible: every bitcoin has the same exact value.

The acronym “NFT” stands for non-fungible token. NFTs are not interchangeable. The paintings of Monet, for example, are non-fungible because they all have different values.

In crypto, NFTs are simply non-fungible digital assets. NFTs can come in the form of digital art or even sports clips. When a digital asset is unique and can not be interchanged, it is considered an NFT.

FAQs

In order to transact on a blockchain, you will need a private key. Private keys are often represented by seed phrases.

Your private key is like your bank password in that anyone that has access to it can access your crypto. Crypto wallets hold your private key for you. Web3 wallets can be either software or hardware. If a centralized exchange, such as Coinbase, holds your crypto on your behalf, they will store your private key for you. This is called a custodial wallet.

The main purpose of blockchain technology is to provide a safe and transparent record of distributed transactions without the need for an intermediary.

Blockchain has many benefits over traditionally centralized ledgers. Some of these benefits include speed, efficiency, pseudonymity, immutability, traceability, and transparency.

The top five blockchains by market cap are, respectively: Bitcoin (BTC), Ethereum (ETH), Binance (BNB), Cardano (ADA), and Dogecoin (DOGE).

📕 Read: Bitcoin vs Ethereum vs Solana vs Polygon: Which Is Best?

A main disadvantage of blockchain today is that centralized exchanges control over 90% of all crypto transactions. This centralization of power exposes blockchains to centralized risks, which was seen recently with the fall of FTX.

Additionally, there are very few regulations in place pertaining to cryptocurrency, which hinders crypto adoption.

🍒 tasty reads

What Is Ether.fi? Liquid Staking Reinvented

What Is Wrapped Ether? Complete wETH Guide

Impermanent Loss in DeFi: The Complete Guide

What is GMX? DeFi Perpetual Exchange 2024 Guide

What Is Defi Liquidity Mining and How Does It Work?

Wrapped Crypto Tokens: A Beginner’s Guide

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.