If injective (INJ) maintains its market relevance, it is expected to recover from its current decline and potentially reach $50 by 2025, $150 by 2030, and over $2,000 by 2040-2050.

Written by: Anatol Antonovici | Updated May 24th, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Injective (INJ) will likely see a price increase from its current levels, possibly reaching $50 by 2025 and $150 by 2030 if it continues attracting DeFi users. In the long term, if the crypto market grows significantly, INJ could surpass $2,000 by 2040-2050 while maintaining its market share.

Table of Contents

🍒 tasty takeaways

2025 Prediction: INJ could target $50 after a potential bullish reversal from its current decline.

2030 Prediction: INJ may trade above $150 if it continues to attract DeFi users, with a bearish scenario around $70.

2040-2050 Outlook: If the crypto market goes mainstream and INJ retains its market share, its price could exceed $2,000.

| Year | Overview | What is Injective? | Injective is a layer 1 blockchain network optimized for DeFi, supporting various on-chain products like DEX infrastructure, bridges, and oracles. |

|---|---|

| 2025 | INJ could target $50 after a potential bullish reversal from its current decline. |

| 2030 | INJ may trade above $150 if it continues to attract DeFi users, with a bearish scenario around $70. |

| 2040-2050 | If the crypto market goes mainstream and INJ retains its market share, its price could exceed $2,000. |

What Is Injective (INJ)?

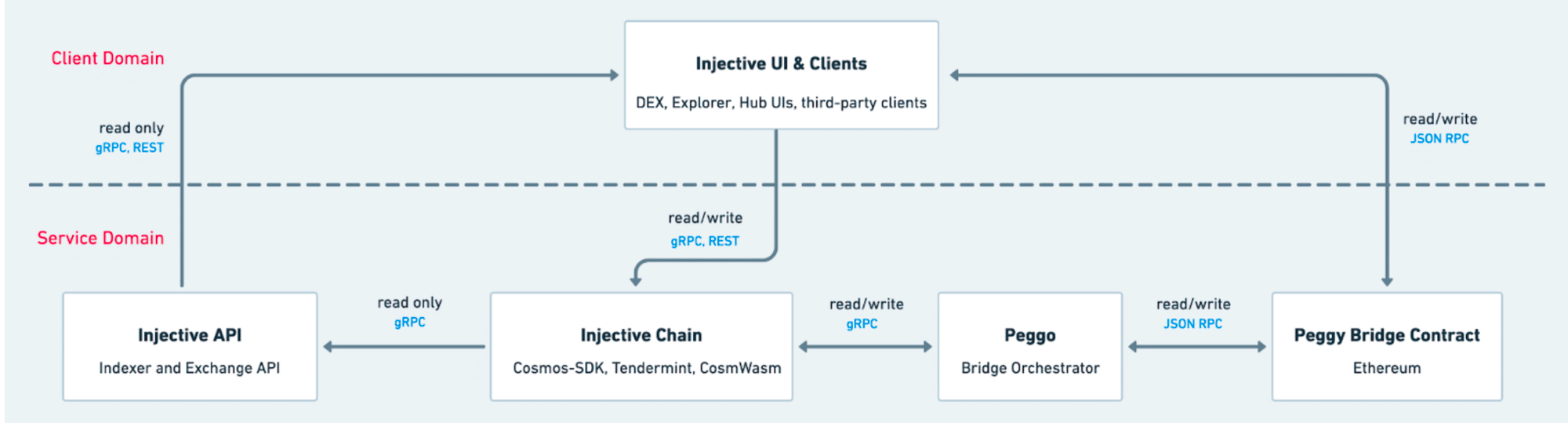

Source: Pintu

Injective is a layer 1 (L1) blockchain network that supports next-gen decentralized finance (DeFi) apps. While Ethereum continues to dominate the DeFi space, accounting for over 57% of the token value locked (TVL), Injective focuses on scalability and efficiency by leveraging artificial intelligence (AI) and smart contracts.

🍒 AI and Crypto: The Future of Blockchain Innovation

Unlike traditional L1s, Injective offers a wide range of DeFi and Web3 products directly on-chain, such as decentralized exchange (DEX) infrastructure, bridges, oracles, and a native smart contract layer. These tools form a comprehensive DeFi development kit for various use cases, including DEXs, margin trading, real-world assets (RWAs), and portfolio management.

Injective prioritizes interoperability, being compatible with other chains, including Ethereum, Solana, and Cosmos.

The ecosystem is fueled by the INJ coin, used for staking, governance, rewards, fees, and collateral.

What’s Unique About Injective?

The main selling point of Injective is that it’s a layer 1 blockchain fully optimized for DeFi. For example, it is the only chain that offers out-of-the-box DeFi modules, such as decentralized order books.

Injective is built with Cosmos SDK, which enables it to offer high throughput and instant transaction finality. It also supports cross-chain transactions by connecting with Ethereum, Solana, and Cosmos.

Injective (INJ) Price Performance

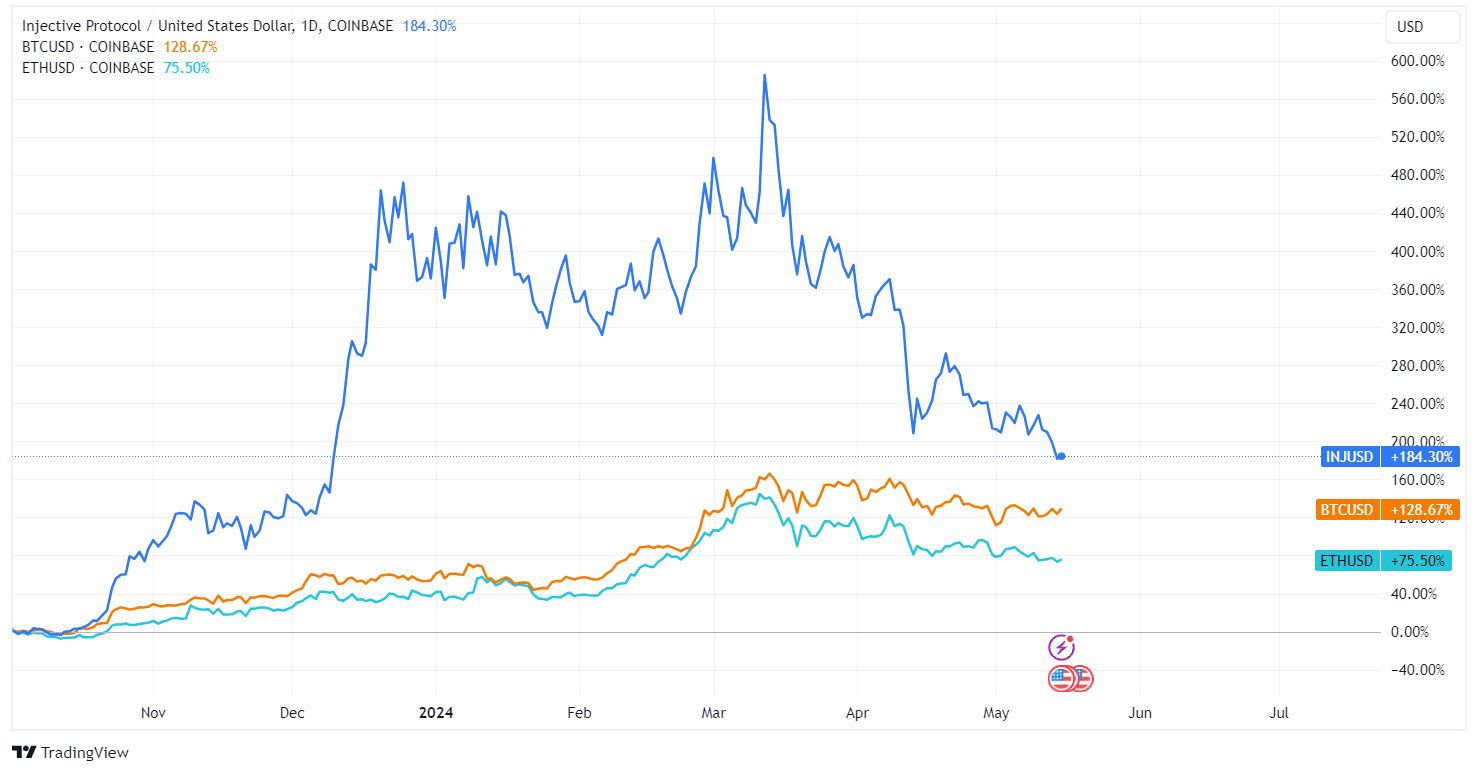

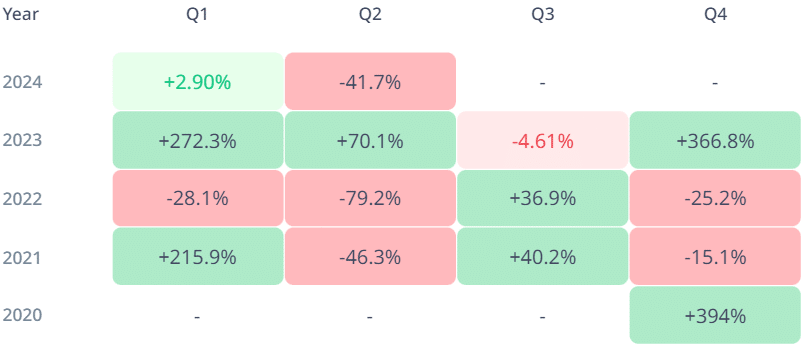

The price of INJ fluctuated near $21.6 as of late-May 2024, having gained over 240% over the last 12 months. It has a market cap of about $2 billion, ranking 50th on CoinMarketCap. The crypto coin has outperformed Bitcoin (BTC) and Ethereum (ETH) since Q4 2023, mainly thanks to a rally at the end of last year.

Source: TradingView

Source: cryptorank

What Drives INJ Price?

The price of an asset reflects the relationship between its supply and demand. In a nutshell, the price is supported by increasing demand for the asset while having an inverse relationship with its supply. Let’s dive deeper into INJ’s tokenomics to get more hints about its valuation and develop an INJ price prediction.

🍒 AI Crypto Coin Prediction: FET, TAO, RNDR, NEAR INJ & More

INJ Supply

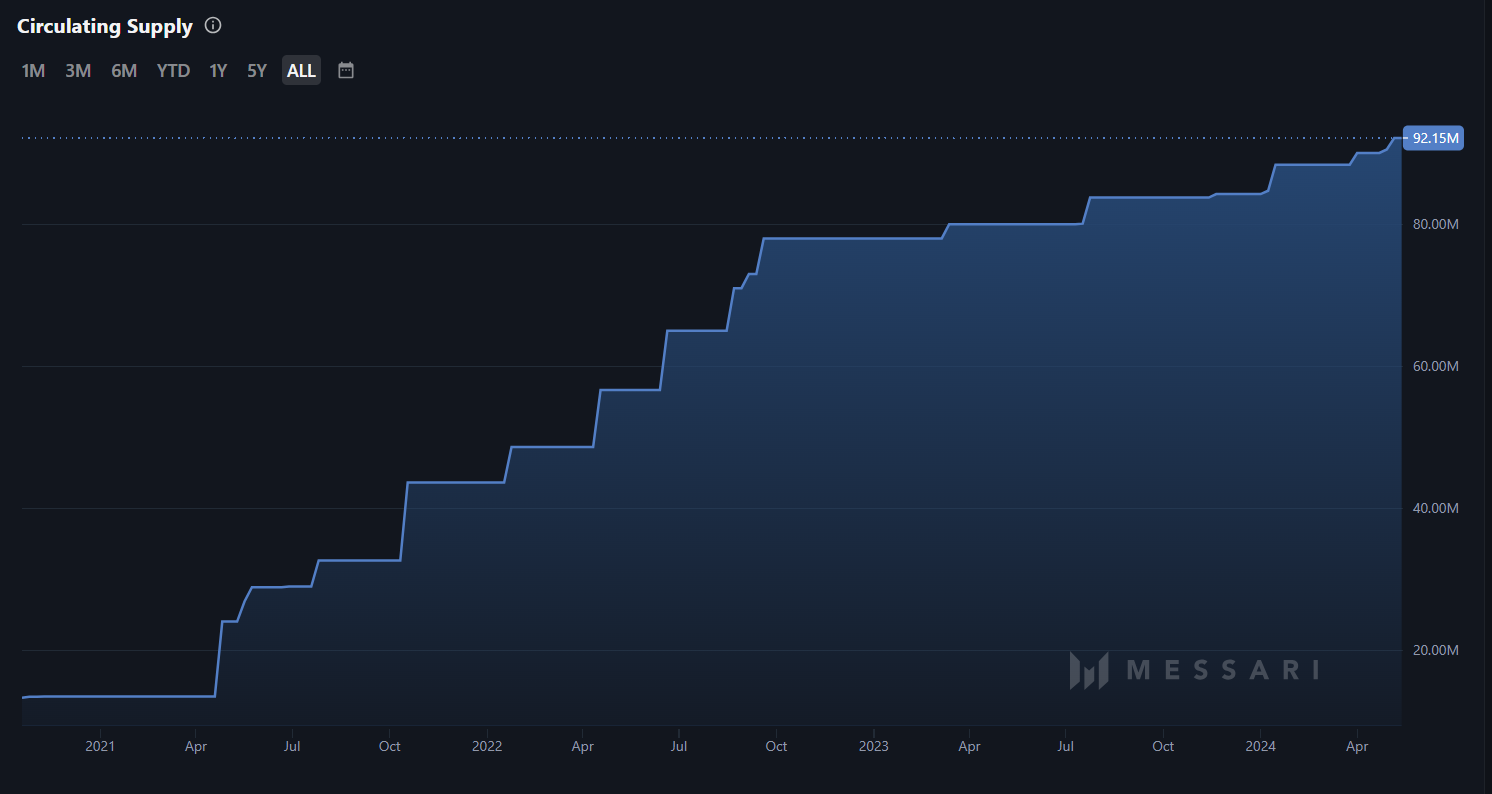

The INJ coin has a total supply of 100 million INJ tokens but no maximum supply limit. This may be a red flag for small crypto projects, but Injective implements a disinflationary model that leverages a burn mechanism to control its supply.

Today, the cryptocurrency’s circulating supply is 93.4 million, which has been gradually increasing since its launch.

Source: Messari

While Injective had an inflation target of 7% at genesis, which was meant to decrease over time to 2%, its circulating supply has actually increased at a rate well over 10%.

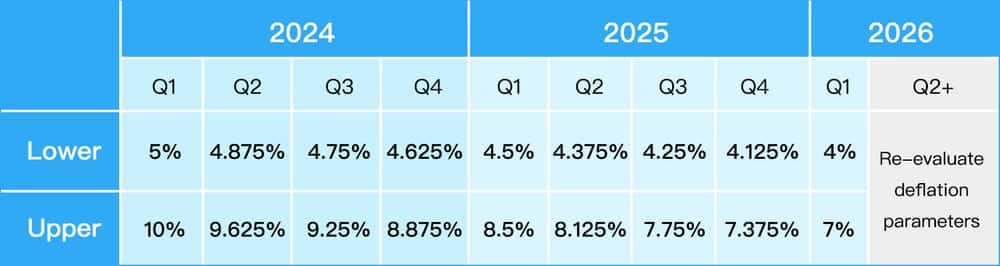

In April 2024, the Injective community voted in favor of IIP-392, thus approving the INJ 3.0 upgrade that will increase deflation by 400% to support the coin’s sustainability over the next two years. Interestingly, the timing of the upgrade coincides with Bitcoin’s halving event.

Here is the new inflation rate schedule:

Source: Injective Blog

INJ Demand

Injective aims to become a leading player in DeFi, although it’s still not a competitor of larger L1’s like Ethereum, BNB Chain, Tron, or Solana. Nevertheless, demand for the network has been gaining traction since H2 2023.

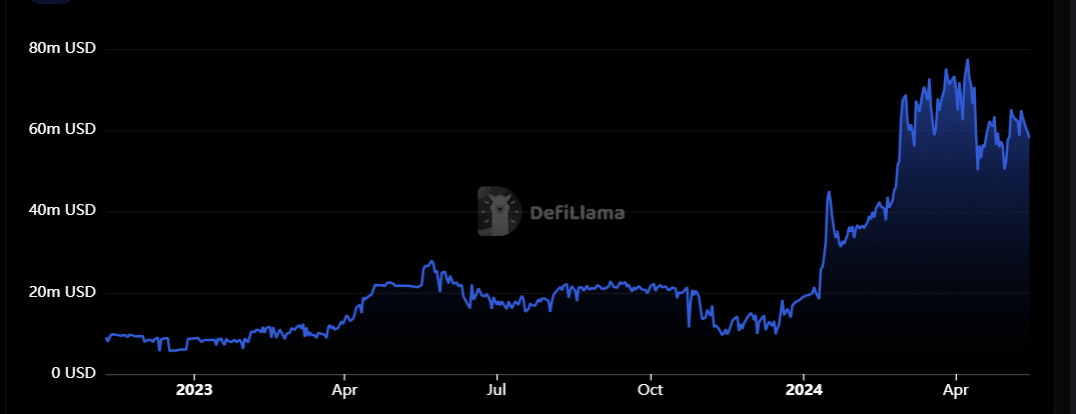

DefiLlama displays 16 decentralzied apps (dapps) built on Injective, with a total value locked (TVL) of 58 million. The TVL peaked in April 2024 at over $77 million. Helix, the largest DEX on Injective, accounts for over 30% of TVL.

Source: DeFiLlama

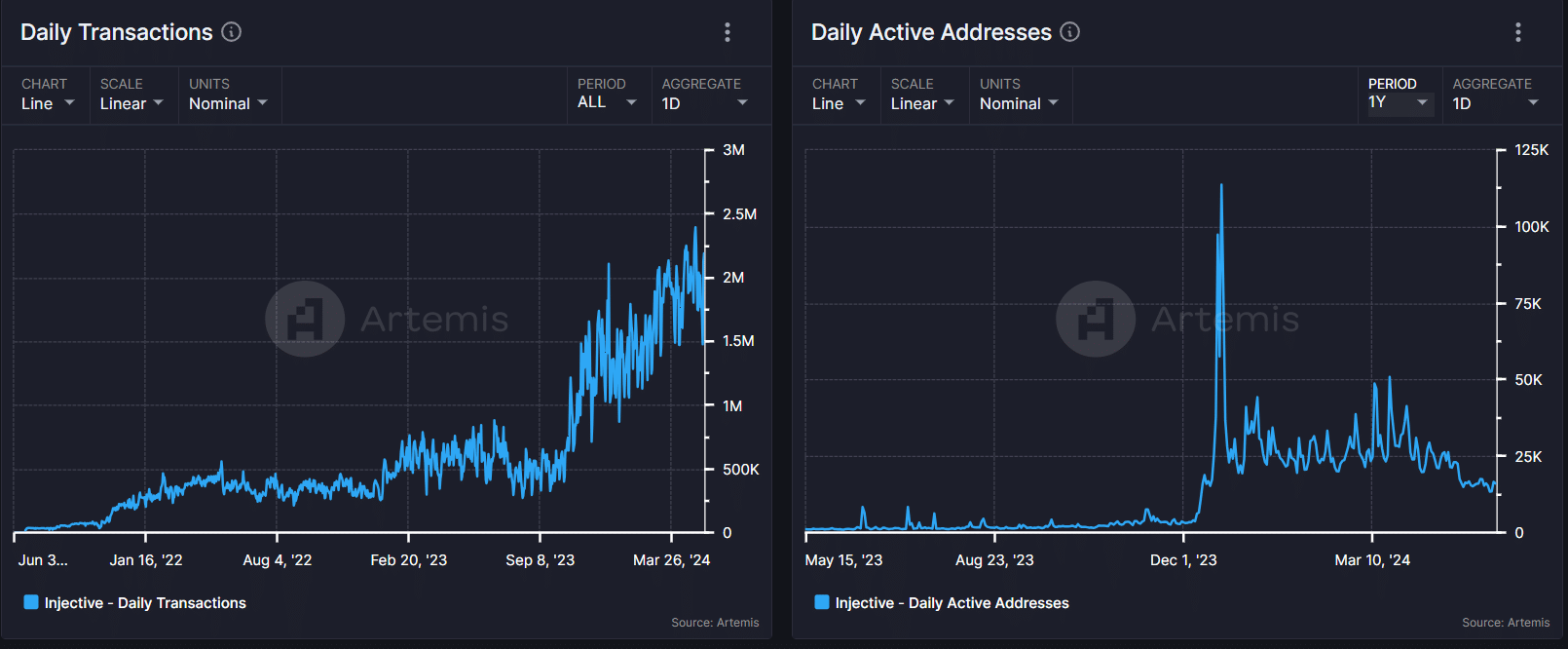

Daily active addresses have declined from over 50k in mid-March to fewer than 15k in mid-May. The only day daily addresses broke above 100k was December 21, 2023.

Although the number of active addresses has decreased, transaction volume continues to increase.

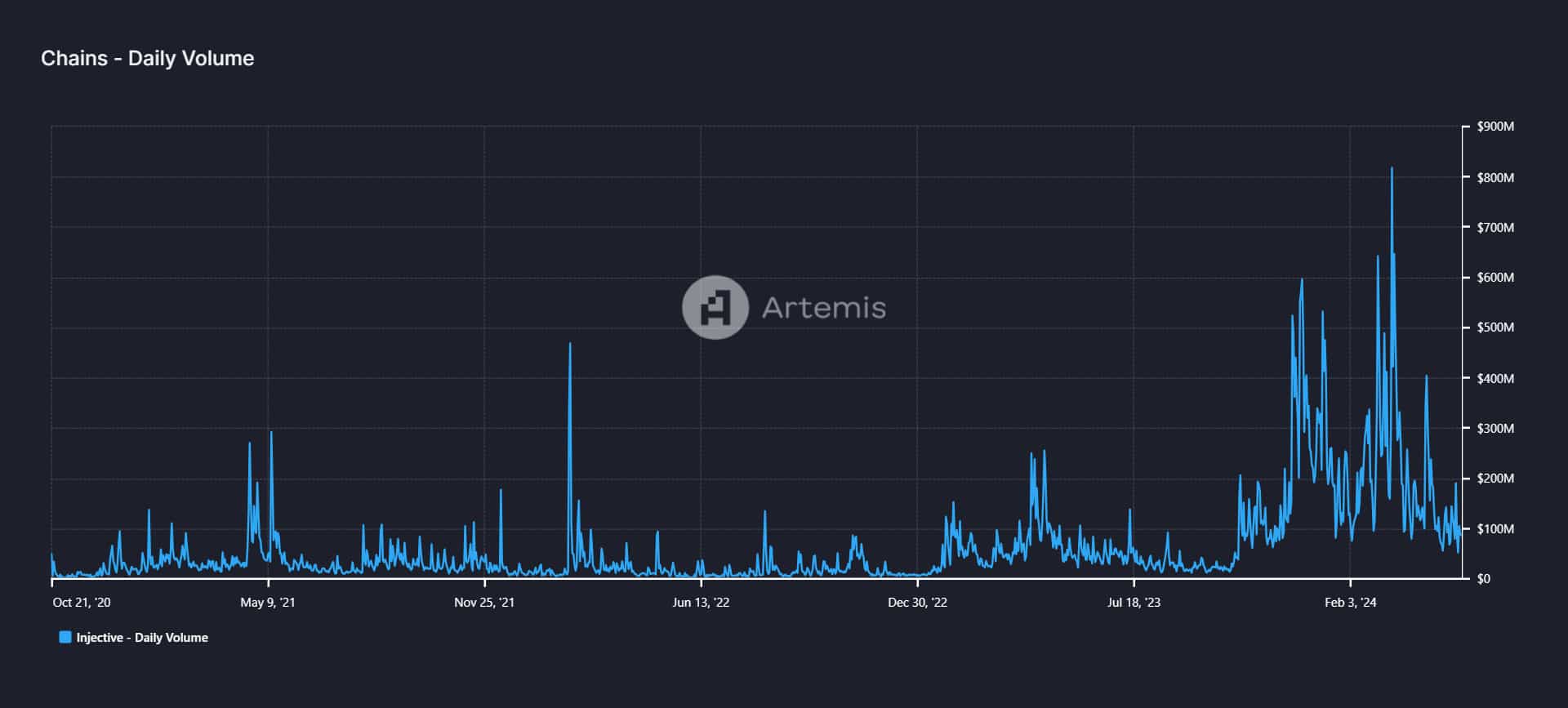

Source: Artemis

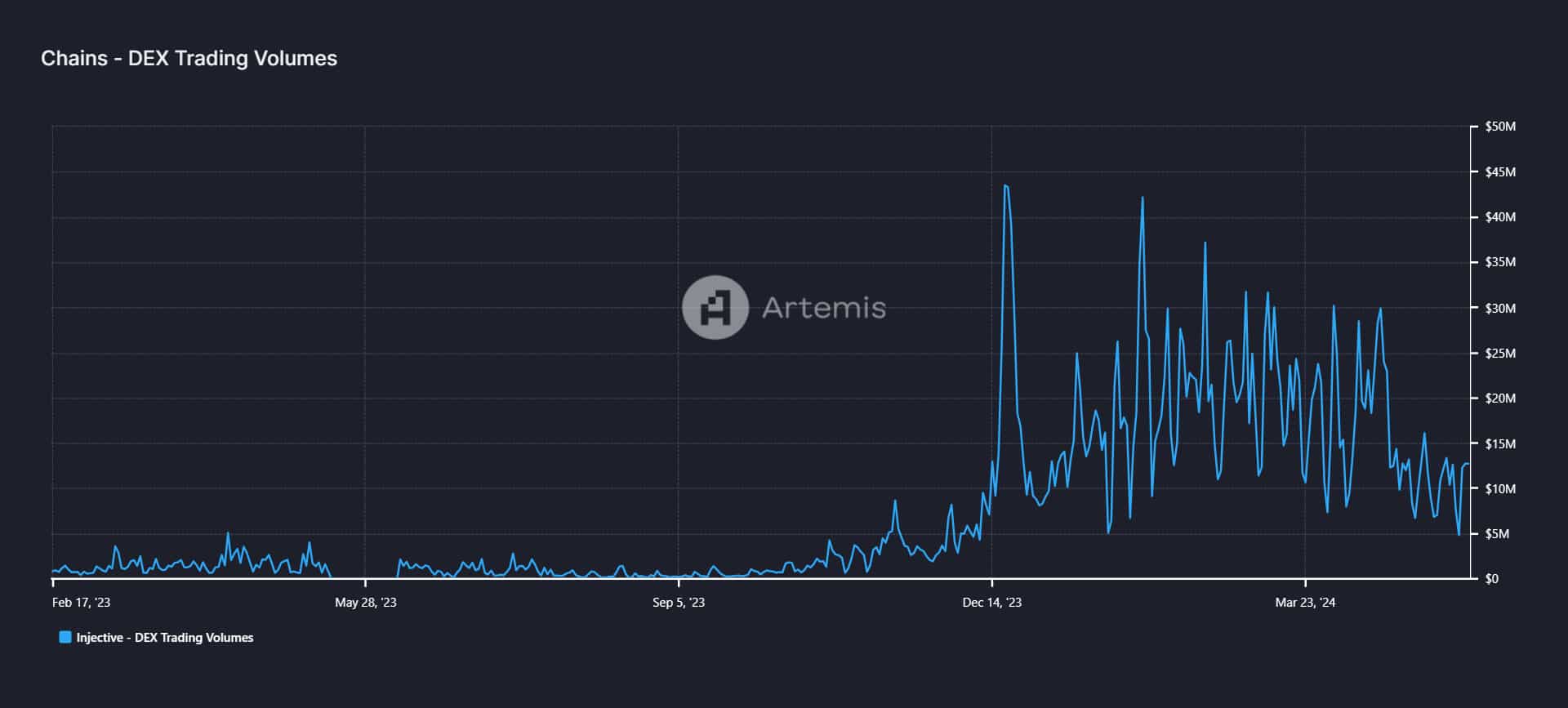

DEX trading volume on Injective peaked in December 2023 and has been losing strength over the last months.

Source: Artemis

All in all, Injective data presents a vague picture with some positive and negative dynamics, making Injective price prediction difficult.

Injective (INJ) Bullish Factors

- Injective has reduced the inflation rate with its latest upgrade.

- The L1 chain has experienced an increase in DeFi TVL and DEX volume.

- Injective has secured tens of millions of USD from investors like Jump Crypto, BH Digital, Pantera Capital, and BlockTower Capital.

Injective (INJ) Bearish Factors

- INJ has a high inflation rate compared to other chains.

- The number of active and new addresses has been declining in 2024.

- Injective has failed to impose itself as a major player in DeFi and faces major competition from Solana.

Injective (INJ) Prediction: 2025

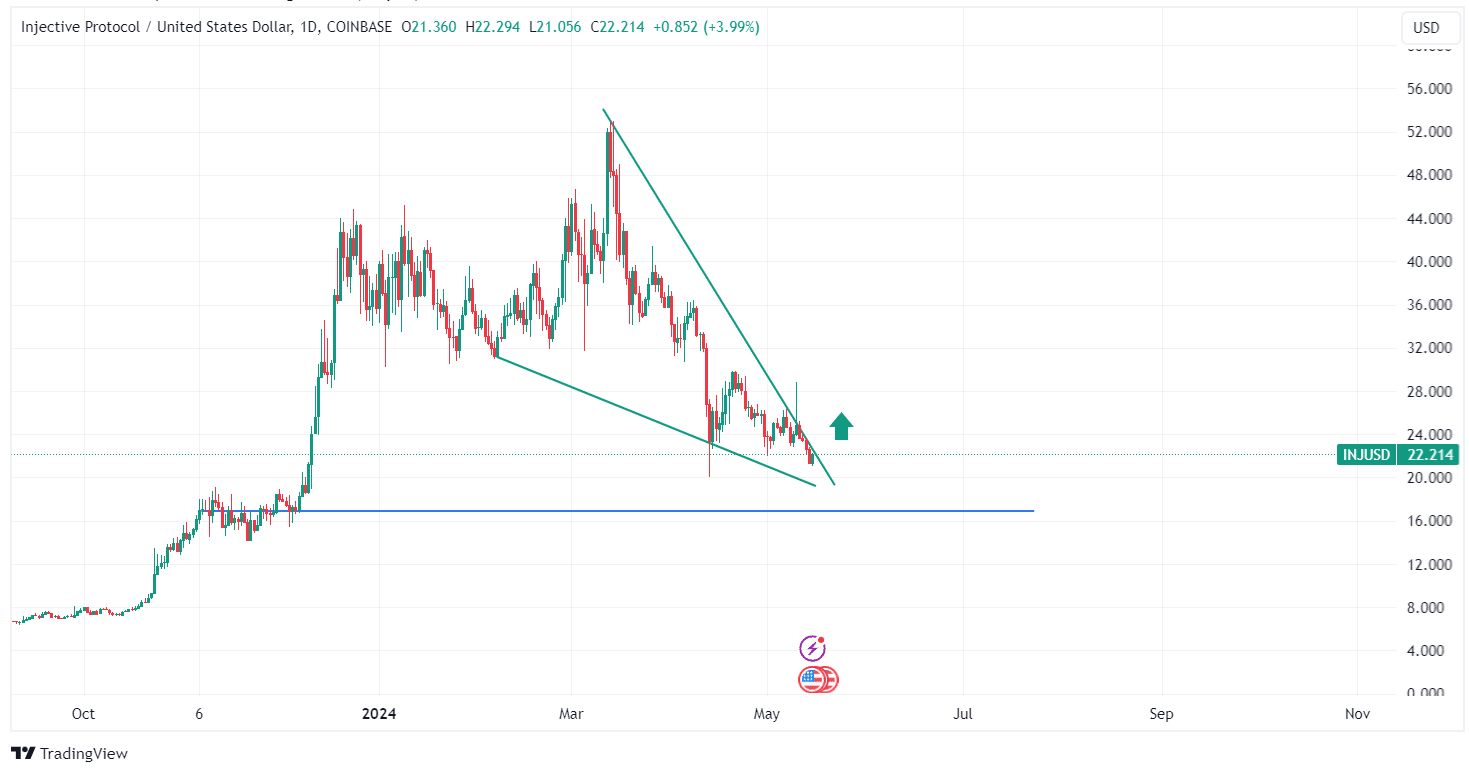

We can do some basic technical analysis for short-term price forecasts. The INJ chart displays a falling wedge pattern, which is a bullish reversal pattern suggesting that the price may recover if it breaks out of the wedge.

Source: TradingView

If it fails to break above the upper line, it may decline to the next support level at $17.

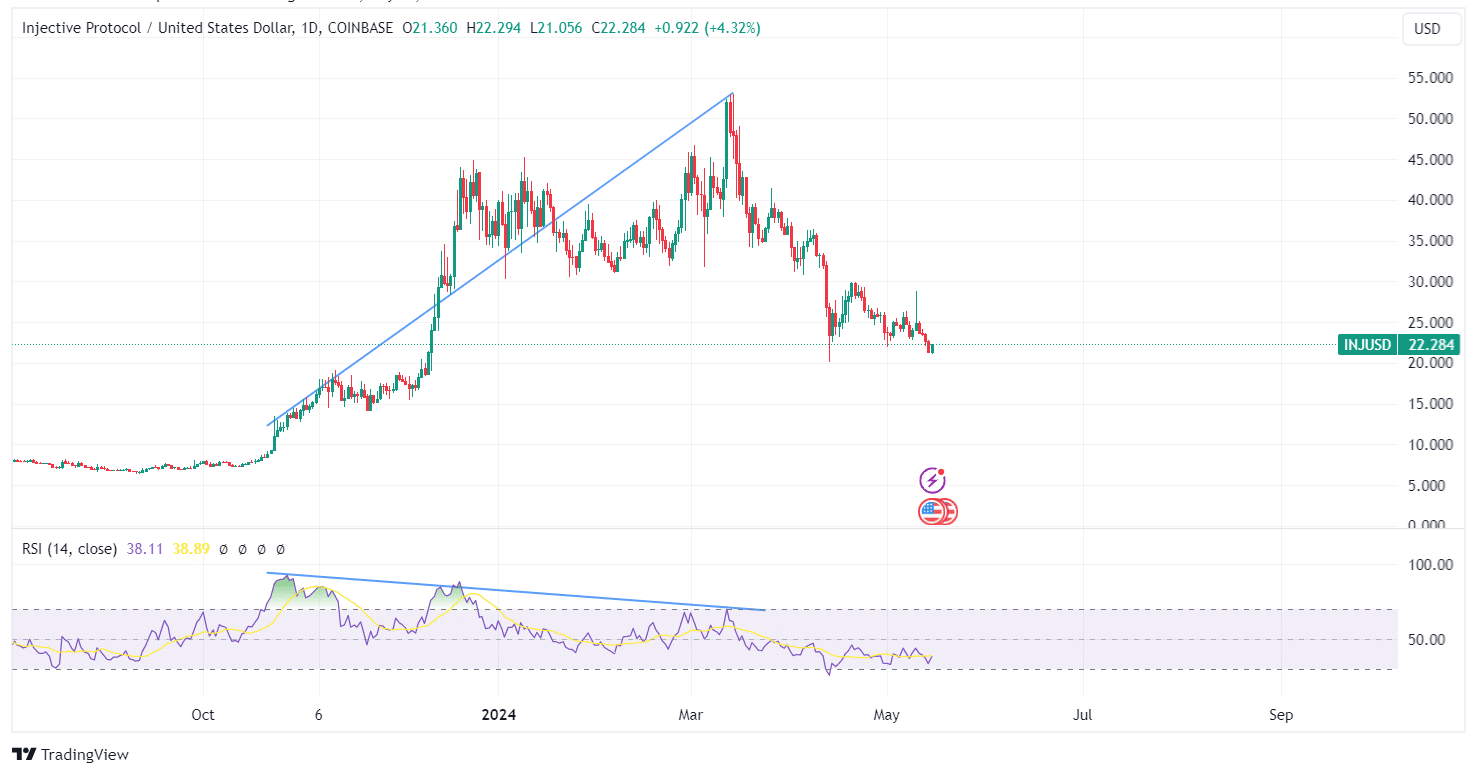

The Relative Strength Index (RSI) previously formed a divergence with the price action, resulting in a downtrend. The oscillator is now close to the oversold level, which may indicate a bullish reversal.

Source: TradingView

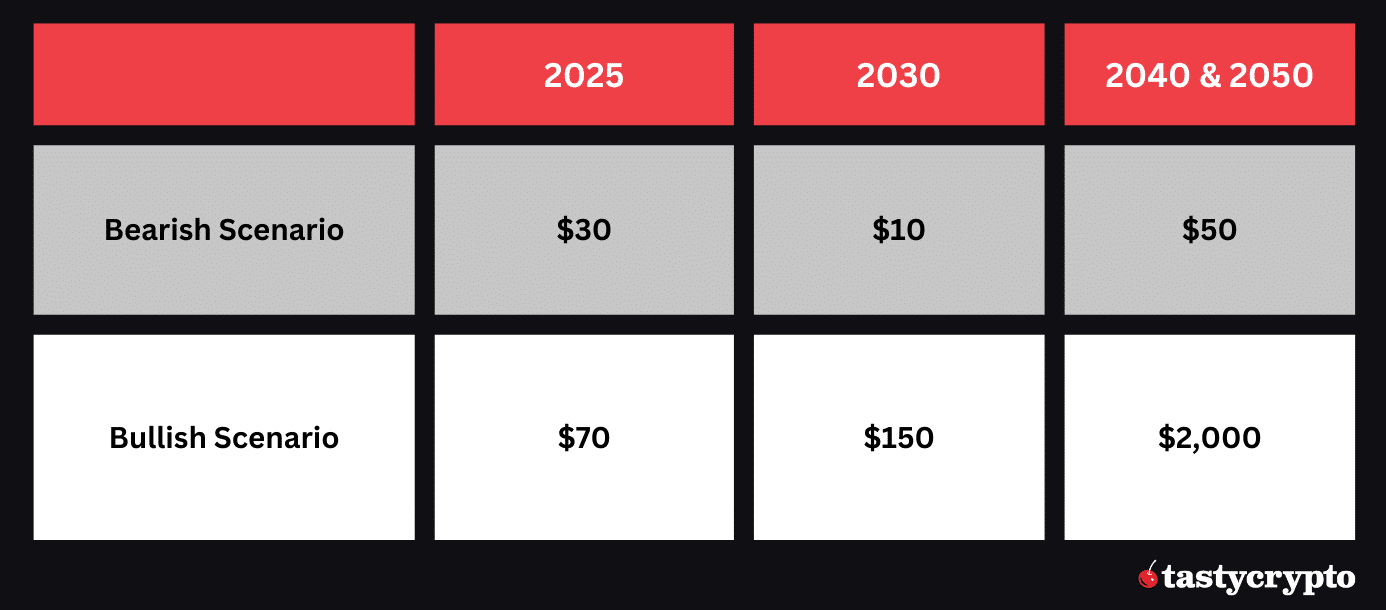

Given the falling wedge pattern and the RSI approaching oversold territory, INJ can target the $50 mark in 2025 after a bullish reversal. If the fundamentals of Injective deteriorate further, the price can remain below $30.

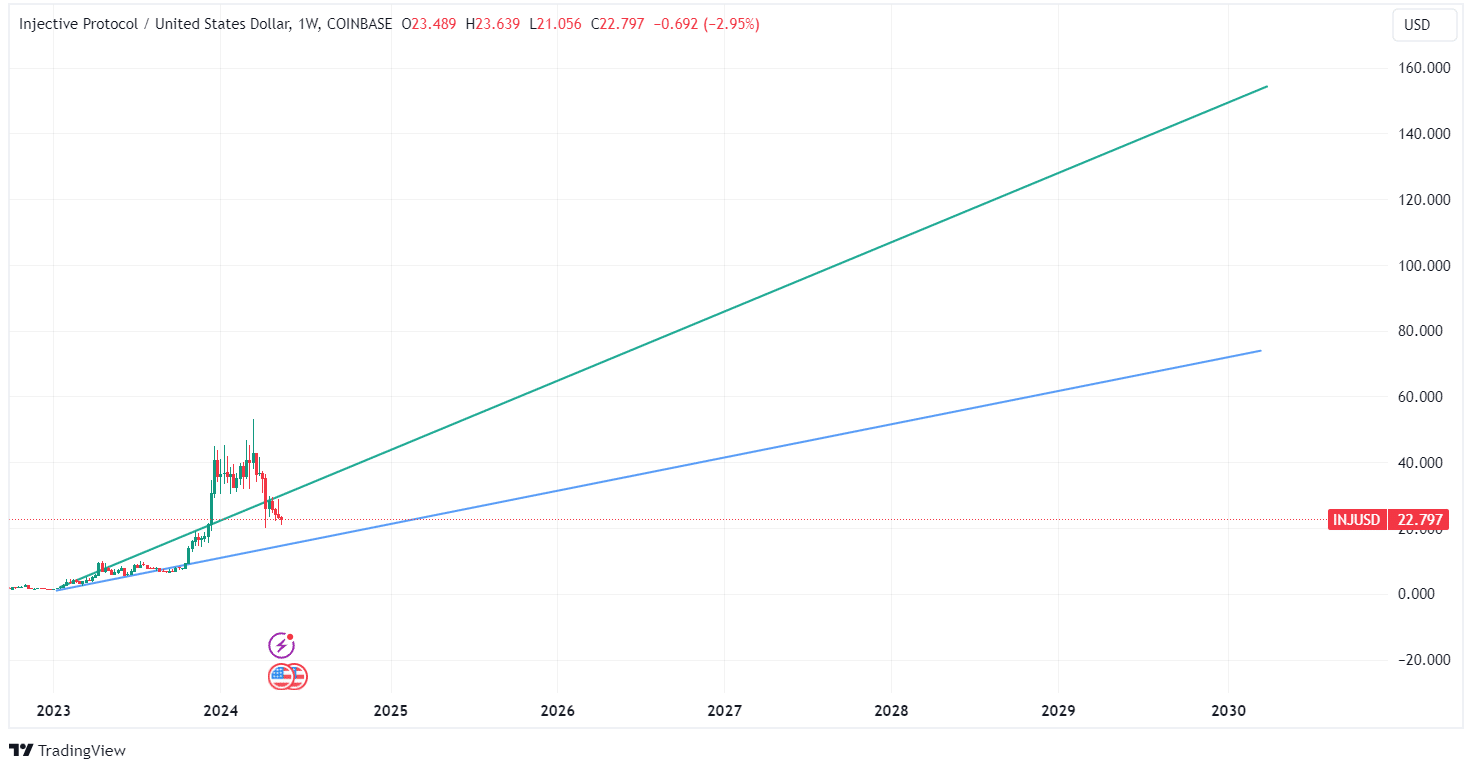

Injective (INJ) Prediction: 2030

While we lack sufficient historical data to make long-term predictions, INJ can trade above the $150 mark by 2030 if it continues to attract DeFi users. In the bear case scenario, it may trade near $70.

Source: TradingView

Injective (INJ) Prediction: 2040 & 2050

Due to their extreme volatility and unpredictability, long-term cryptocurrency price predictions are highly speculative.

If the crypto market goes mainstream and explodes to $200+ trillion in the coming decades, INJ can demonstrate generous returns if it stays relevant. If it maintains its current 0.1% market share, its price can surge to over $2,000.

FAQs

What will the price of Injective be in 2025?

After a bullish reversal, INJ could target the $50 mark by 2025, but if fundamentals deteriorate, the price range can remain below $30.

What will the price of INJ be in 2030?

INJ could trade above $150 by 2030 if it continues to attract DeFi users, but in a bearish scenario, it may trade near $70.

How far can INJ go in 2040 & 2050?

If the cryptocurrency market goes mainstream and INJ maintains its current market share, its price could potentially exceed $2,000 by 2040 or 2050.

Where can I buy INJ?

INJ can be purchased on major crypto exchanges, such as Binance or Coinbase, and DEXs like Osmosis and Helix using a self-custody wallet.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com