Author: Ryan Grace

February 14, 2025

Good morning my tasty friends, I hope you’re all having a wonderful start to your weekend.

It’s been a slow week in the markets, but as you know, we’re always cooking in the cave. We’re launching a new show called Beans, there are more tokens now at tastytrade, and we’ve got new research on crypto portfolio allocation.

We’ll get to the research in a moment, but first… let’s take a look at these boring ass markets.

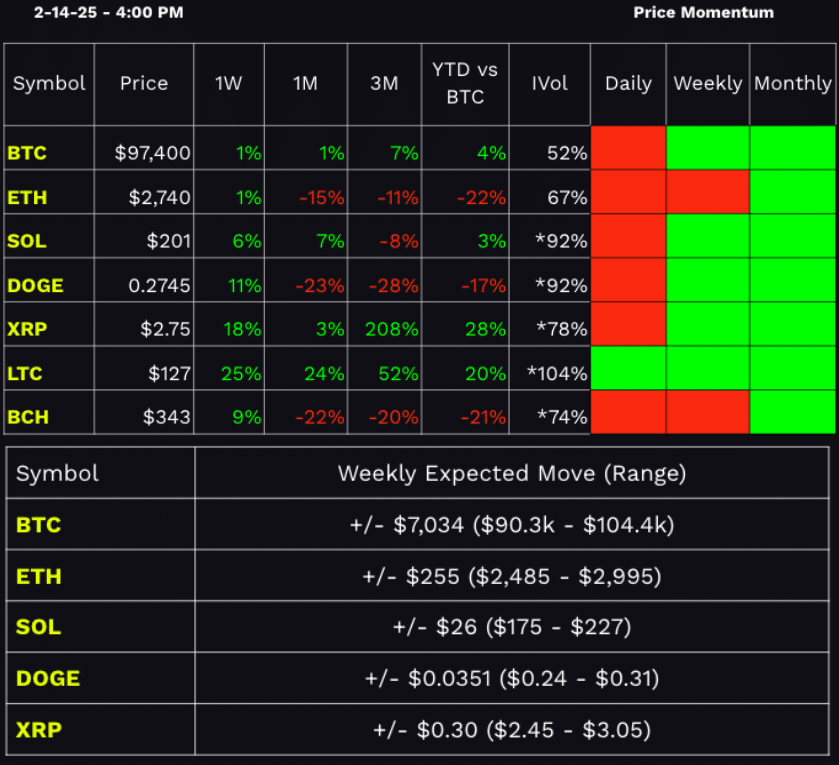

Bitcoin has been boring from week to week, but some tokens are catching a bid after getting hit by tariff induced vol earlier this month. LTC is outperforming BTC and bucking the bearish trend after we got a bullish momentum signal on Tuesday. We’ll see if any others will follow its lead, at the time of writing SOL and XRP are also outperforming BTC YTD, though bitcoin market cap dominance remains near 60%.

BTC vol has basically collapsed, for now, with implied volatility trading at 50%. The low for bitcoin vol over the last year is about 42%, so we’re getting close to an IV Rank of 0. With lower implied volatility comes tighter expected trading ranges, but don’t get complacent.

Looking ahead, volatility is pricing in a 7% move on the week for bitcoin, and we know it quite often moves by a lot more than this.

The Crypto Investor’s Guide to Portfolio Rebalancing: A Data-Driven Analysis

What’s in your bag?

Crypto markets are notorious for their volatility. Bitcoin alone has seen multiple drawdowns exceeding 50% in a matter of months, while altcoins regularly experience even wilder price swings. As an investor, managing risk while optimizing returns is crucial.

Unlike traditional markets where equities and bonds provide a natural degree of diversification, crypto remains a highly correlated asset class. This raises an important question:

How can people build or manage a crypto portfolio to maximize returns while also minimizing risk?

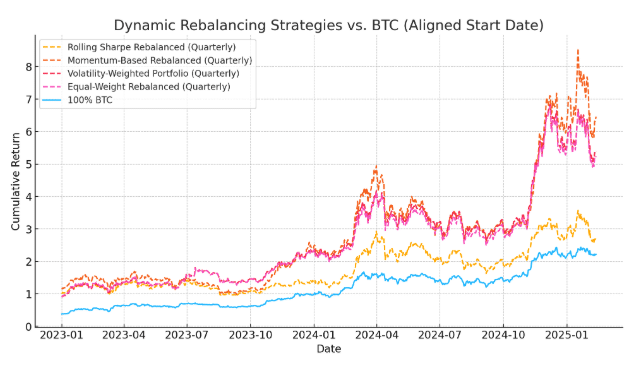

In this deep dive, we analyze various rebalancing strategies—including Rolling Sharpe Ratio, Momentum-Based, Volatility-Weighted, Equal-Weight, and BTC-only (HODL) to identify the most effective approach.

Using historical data from February 10, 2022, onward, we assess risk-adjusted performance, volatility, and drawdowns to determine which strategy has worked best in the unpredictable world of crypto markets.

The Study: How We Evaluated Crypto Portfolio Strategies

For this exercise, we gathered historical price data for Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), Bitcoin Cash (BCH), Solana (SOL), Dogecoin (DOGE), and XRP. Then, each strategy was tested using backtested rebalancing approaches, evaluating returns, volatility, and Sharpe ratios.

We tested the following rebalancing approaches:

Rolling Sharpe Ratio Rebalancing (Quarterly) – Allocates capital to the top-performing assets based on their Sharpe ratio, selecting the best risk-adjusted opportunities each quarter.

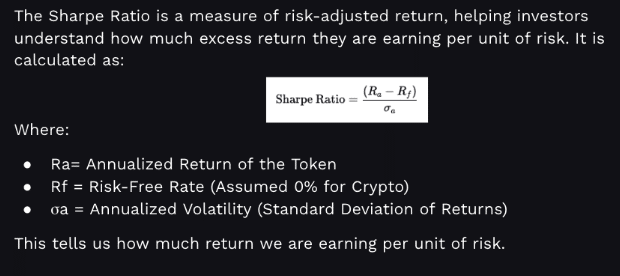

If you’re not familiar with Sharpe Ratios, the ratio is used as a way to measure risk-adjusted returns, in a way, helping investors understand how much excess return they are earning per unit of risk. It’s widely used in portfolio management to compare the performance of different investments or strategies.

A Sharpe Ratio above 1.0 is generally considered good, above 2.0 is very strong, and above 3.0 is exceptional.

Momentum-Based Rebalancing (Quarterly) – Selects the top-performing tokens based purely on trailing 3-month returns.

Volatility-Weighted Portfolio (Quarterly) – Allocates capital inversely to each asset’s historical volatility, favoring more stable assets.

Equal-Weight Rebalancing (Quarterly) – Rebalances each asset equally every quarter, ensuring broad diversification.

100% BTC (HODL) – Maintains a static BTC-only position as a benchmark.

Each strategy was then compared using:

- Annualized Returns

- Annualized Volatility

- Sharpe Ratio (Risk-Adjusted Return)

- Sortino Ratio (Downside Risk-Adjusted Return)

- Maximum Drawdowns (Worst Peak-to-Trough Losses)

Performance Breakdown: Which Strategy Delivers the Best Returns?

Let’s take a look at the results.

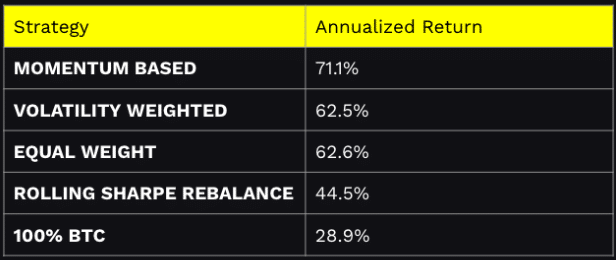

Annualized Returns

The Momentum-Based Rebalanced Portfolio generated the highest annualized returns, suggesting that chasing short-term winners can yield outsized gains in crypto bull markets. However, this comes at the cost of extreme volatility and deeper drawdowns.

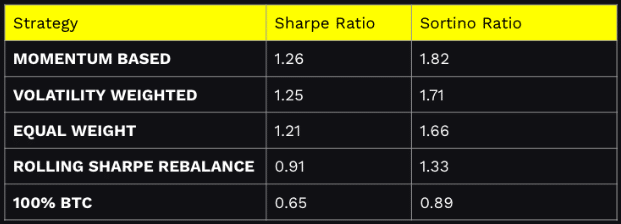

Risk-Adjusted Returns: Sharpe & Sortino Ratios

The Sortino Ratio is a refinement of the Sharpe Ratio that specifically measures risk-adjusted returns, but instead of penalizing for total volatility, it only considers downside risk (i.e., negative volatility). This makes it particularly useful for crypto and other high-volatility assets, where upside volatility isn’t exactly a bad thing.

The Volatility-Weighted Portfolio emerged as the most efficient strategy in terms of risk-adjusted returns. It produced a higher Sharpe ratio (1.25) and Sortino ratio (1.71), meaning investors were compensated more per unit of risk compared to BTC-only investing.

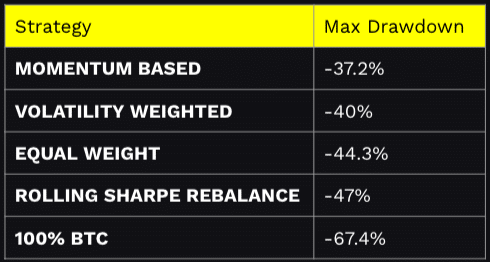

Risk Analysis: Drawdowns & Volatility

While high returns are attractive, the ability to manage losses during downturns is critical.

Maximum Drawdowns

Once again, Volatility-Weighted Rebalancing had the lowest drawdowns (-37.2%), making it the safest option in bear markets. BTC-only suffered the most significant losses, reinforcing the need for diversification.

Rolling Volatility

Momentum-based investing saw the highest volatility swings, making it riskier despite its strong returns. Conversely, the Volatility-Weighted strategy smoothed out risk by allocating more to stable assets.

Rebalancing is Essential in Crypto Investing

Crypto’s volatility demands a disciplined approach. Our research shows that dynamic rebalancing significantly outperforms a passive BTC allocation by maximizing returns while controlling risk.

For investors seeking the best balance of performance and risk management, the Volatility-Weighted Portfolio is the most efficient choice.

Meanwhile, traders with a higher appetite for risk may prefer Momentum-Based Rebalancing in bull markets, while Rolling Sharpe Rebalancing offers a steady middle ground.

No matter the strategy, rebalancing beats passive investing in the crypto space.

Web3 Word of the Week (W3WOW)

Show Highlights

- Katie is Rotting

- BEANS are brewing

- Ryan’s cycle watch