Author: Ryan Grace

February 7, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend.

Another big week here in the cave. We’ll cover the market moves in a moment, but first, an important announcement.

XRP is now available through tastytrade. Here’s what you need to know.

What is Ripple?

While XRP and Ripple are often used interchangeably, this is actually incorrect. (I’ve made this mistake before…I’m learning). Ripple is the private company that’s behind the development of a global payments platform designed to facilitate fast, low-cost cross-border transactions.

At its core, there are two major components: RippleNet and the XRP Ledger (XRPL). Across the platform, XRP is the native token (cryptocurrency) of the XRP ledger and is also used as a bridge asset for cross-border payments on RippleNet.

- RippleNet – A payment network that enables financial institutions to send money across borders efficiently. While XRP can be used within RippleNet, it’s not required.

- XRP Ledger (XRPL) – A decentralized public blockchain where XRP serves as the native cryptocurrency. XRPL supports smart contracts, token issuance, and NFT creation, making it functionally similar to other Layer 1 blockchains like Ethereum and Solana.

- XRP – Native token of the XRP blockchain.

Let's Focus on RippleNet first.

RippleNet’s primary value prop is its ability to facilitate efficient cross-border transactions between different financial institutions.

To use this service, institutions integrate with the network and then RippleNet processes the payment details, much like the SWIFT network (Society for Worldwide Interbank Financial Telecommunications).

XRP is not required for this process to work, but using it enables “on-demand liquidity” – The real feature positioning RippleNet as a potentially better alternative to the existing system. By using XRP, institutions can send cross-border payments without the need for pre-funded accounts. For example, a business can convert USD to XRP, transfer the funds instantly, and settle in Mexican Pesos within seconds. As a result, RippleNet transactions leveraging XRP’s on-demand liquidity feature are faster, cheaper, and instantly visible, compared to most traditional bank transfers.

To be clear, RippleNet is not decentralized in the same way public blockchain networks like Bitcoin or Ethereum are. Instead, it’s a centralized network for banks and other financial institutions to settle transactions more efficiently with blockchain technology. According to Ripple’s Amazon AWS partner profile, there are a number of institutions that have signed on to use RippleNet today.

What about XRPL, the decentralized blockchain network?

Unlike RippleNet, which is a private enterprise solution, XRPL is a public blockchain anyone can use or build on.

The XRP Ledger is a separate entity from RippleNet and operates independently of Ripple (company). If this isn’t confusing… The XRP Ledger was developed first, around 2012, prior to the establishment of Ripple the entity.

Seeking to build a “better bitcoin” developers David Schwartz, Jed McCaleb, and Arthur Britto launched the XRP ledger and then joined forces with Chris Larsen to form Ripple (first called OpenCoin, then Ripple Labs).

As a decentralized blockchain, Ripple doesn’t control XRPL, but it’s a major contributor to the chain and is building products on it.

Similar to Ethereum and Solana, XRPL supports programmability and tokenized assets. Though, unlike these chains, XRPL uses a separate consensus mechanism called the Ripple Consensus Protocol Algorithm and it doesn’t involve miners or staking, which in turn makes XRPL relatively more energy efficient.

While similar to Ethereum or Solana, it’s a bit more limited in its functionality, at least for now. Instead of native smart contracts, XRPL has what it calls “hooks” which introduce rules for basic automations. The core development team is also working on rolling out an automated market maker for token swaps and there are potential real-world asset use cases too.

The Investment Case for XRP

XRP is the native asset of the XRPL ledger and plays a role in the broader ecosystem by facilitating on-demand liquidity across RippleNet, but what supports its current market cap of $130 billion?

What’s the investment case?

Well my friends… Like much of crypto at this stage, valuation is primarily driven by speculative forces. This speculation centers largely around network effects.

The narrative is that if global financial institutions use RippleNet for cross-border payments with XRP for on-demand liquidity, then demand for XRP will go much higher.

There are some signs of this today, but adoption has been relatively slow to start. It’s hard to argue current on-chain activity justifies its massive valuation but there’s reason to believe in the future of XRP and the XRP Ledger.

Ripple has racked up some wins against the SEC, and we know real-world assets are a growing use case, so an eventual regulatory stamp of approval could certainly bring more institutions to the table.

A formal regulatory green light could attract more institutional participants, potentially leading to fundamental growth that supports XRP’s price—but for now, its market cap appears to be driven more by speculation than actual network usage.

I don’t own this personally, and it’s not that I’m a hater, I just haven’t paid much attention to it until recently. That said, regardless of what you think about valuations… It’s been a pretty good trade and I know many of you have been in it for a while.

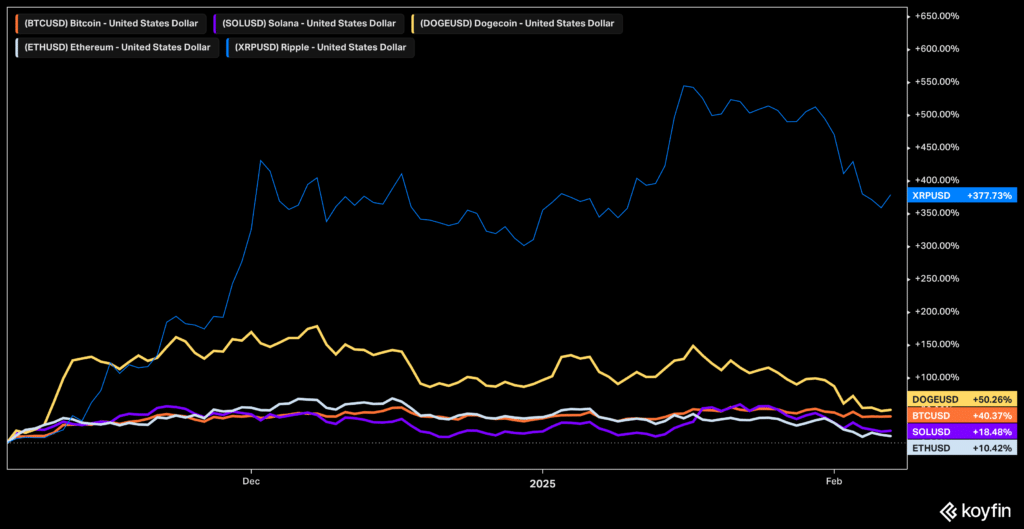

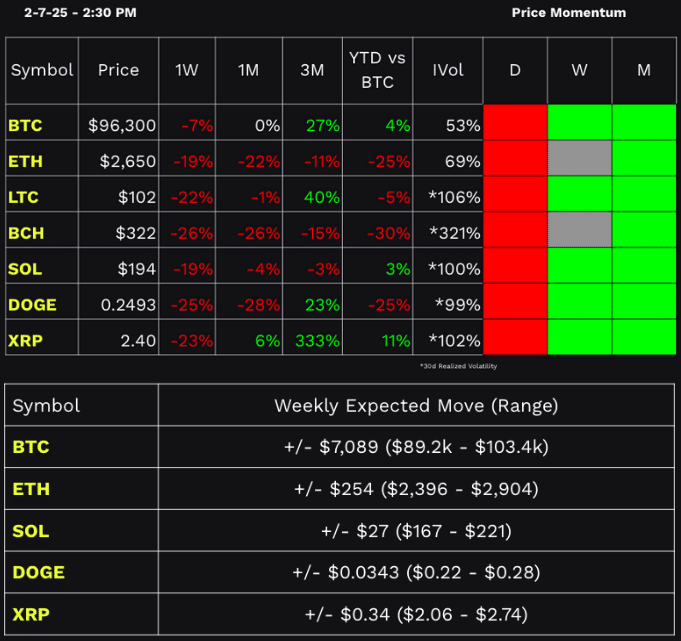

Performance Dashboard

A crappy week for the coins.

The market has been short-term bearish and not much has changed since our mid-week update Wednesday.

Last weekend’s temporary tariff announcements rocked the market and there hasn’t been much of a recovery since. Leverage has been unwound and almost everything is down 10-20% on the week or worse. This is pretty normal from a crypto vol perspective, but it doesn’t make it feel any better.

Given the size of the move, short-term momentum is bearish, per our indicators, but fortunately this hasn’t spilled over into more meaningful weekly or monthly periods… At least not yet. Should this materialize, we’ll let you know.

For now, implied volatility continues to contract, signaling smaller expected moves, but these ranges are pricing in lower lows vs where we were just a few weeks ago. I’m not trying to scare anyone, but BTC back into the 80s and ETH retesting the recent lows currently has a statistically relevant probability.

At the same time, sentiment among the animals on X is so negative you’d think we’re in the middle of a bear market, which could be a solid contra-indicator on its own.

February could stay choppy and there’s clearly a lot happening outside of crypto, but I see no real indication that this is the beginning of the end of the cycle. Corrections around 20% are to be expected during bull markets if history is any indication. If this is indeed one of them, the mid-80s (if we get it) is where I’d likely look to add some size to my core position. On the flip side I’m taking some off the table on a move back towards 110.

Keep your head on a swivel.

Stay tasty,

Ryan

Web3 Word of the Week (W3WOW)

Show Highlights

- Ripple doing Ripply things

- What does South Park have to do with the blockchain?

- Cookie Monster x Science = Ryan?