Author: Ryan Grace

January 31, 2025

Hello my tasty friends, I hope you’re all having a wonderful start to your weekend.

The dust has settled after a volatile start to the week and now we find ourselves back in positive territory.

Outside of markets, we’ve got a lot cooking in the cave per usual. This week we’re focused on Solana (now available at tastytrade), Real World Assets, and the macro road ahead.

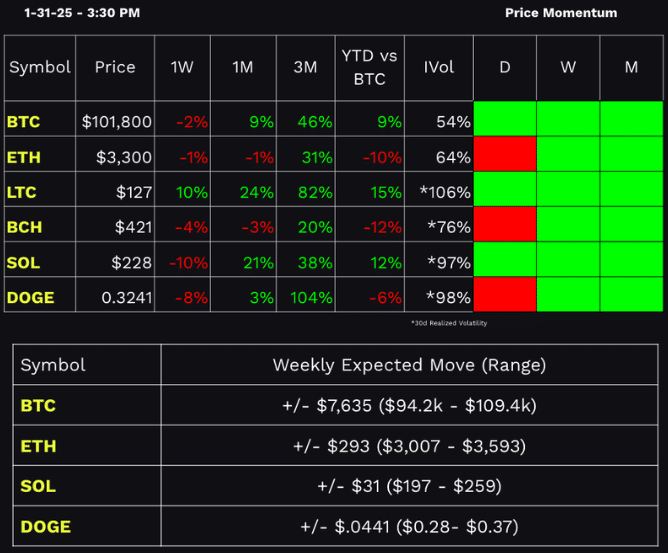

But first… Performance Dashboard and Expected Moves:

January has been a chop fest, with Bitcoin fluctuating between 90-110 as sentiment swings from super bullish to frantic bearishness on a weekly basis. An onslaught of Trump/SEC/Reg/ CRYPTO CAPITAL OF THE PLANET!!!!! developments continue to shape the narrative, while anonymous animal accounts on X pontificate on the path forward. What’s priced in? What isn’t?

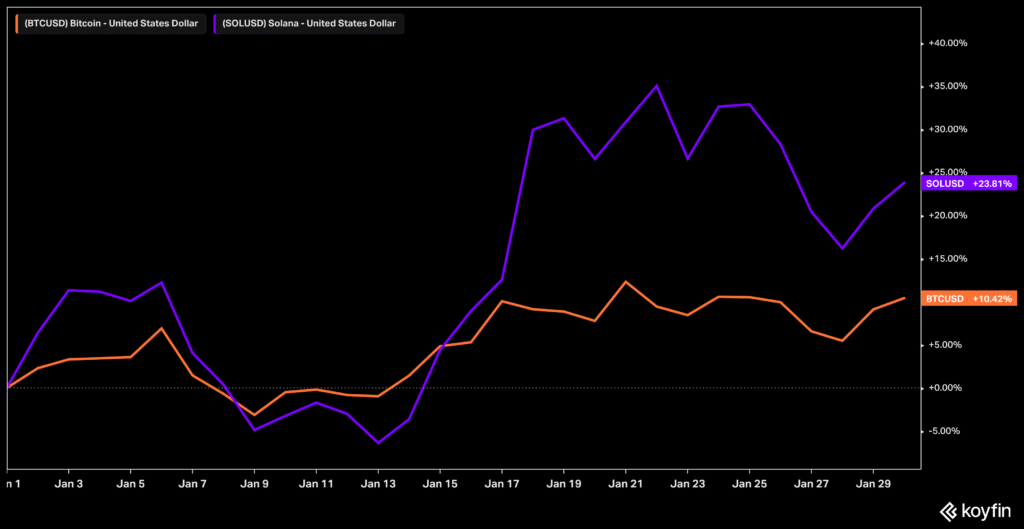

Quick sanity check, and BTC is still up double digits year-to-date. It’s been a long month, but if you were able to jump off the AI/meme rocket before it exploded (unlikely) or are mostly in the big dawg BTC (more likely), you’re alright. BTC dominance is back at 60% and not much has outperformed the king. With one exception…Solana.

If you’ve been cruising the seas with me on the back of the jet ski, you know we’ve got some Solana in the bag. Personally, Solana is the third-largest position in my crypto portfolio and we’ve covered it here a few times before. Is SOL the Next Market Darling?

I think SOL makes sense and have convinced myself it will go higher for a variety of reasons, but first I’ve gotta shout-out the team at tastytrade. The development team has wired up the machines and now both SOL and DOGE are available for trading. I hear XRP and more are coming next week too.

For starters, what is Solana?

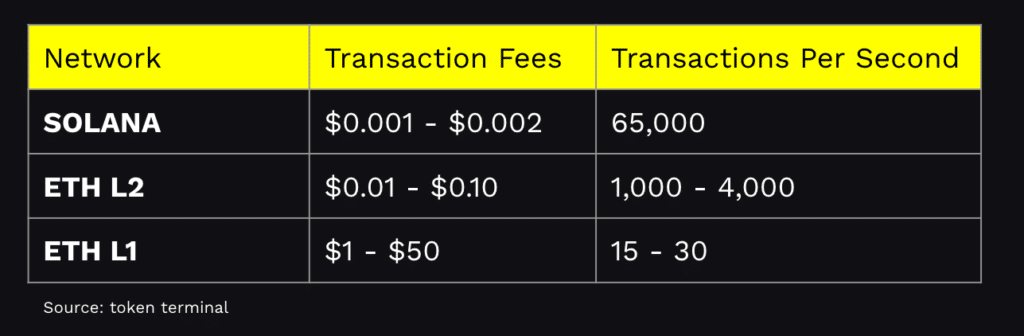

I’m a simple man, so let me put this in simple terms. Solana is a layer-1 blockchain network that does a lot of the same things as Ethereum (tokens, DeFi, NFTs), but cheaper and faster.

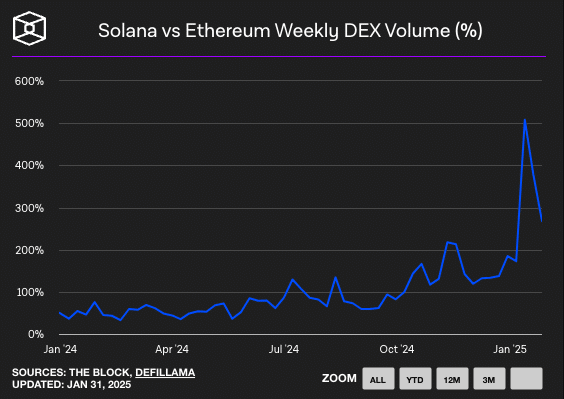

Now, cheaper and faster isn’t always better, there are tradeoffs, but for many users Solana is emerging as a pretty good chain for trading meme coins and AI agent tokens. Don’t take my word for it though, let’s look at the numbers.

Why am I interested in Solana?

If you build it they will come.

The Solana network went live in 2020, survived the FTX collapse, and has the technical capabilities to compete with Ethereum. Its architecture enables high performance and scalability, leading some to believe it could serve as a real-time global settlement layer for trading — à la ‘Nasdaq on the blockchain.

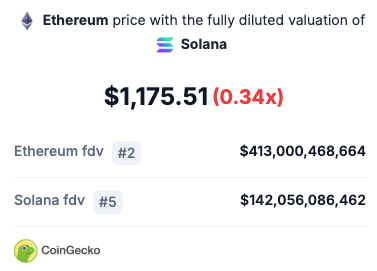

For a general comparison between Solana and ETH, please see below.

Solana has a compelling proposition, but is there any fundamental evidence to support an investment in the network?

It’s important to do your own research, but for starters, here are some data points that standout to me when analyzing Solana.

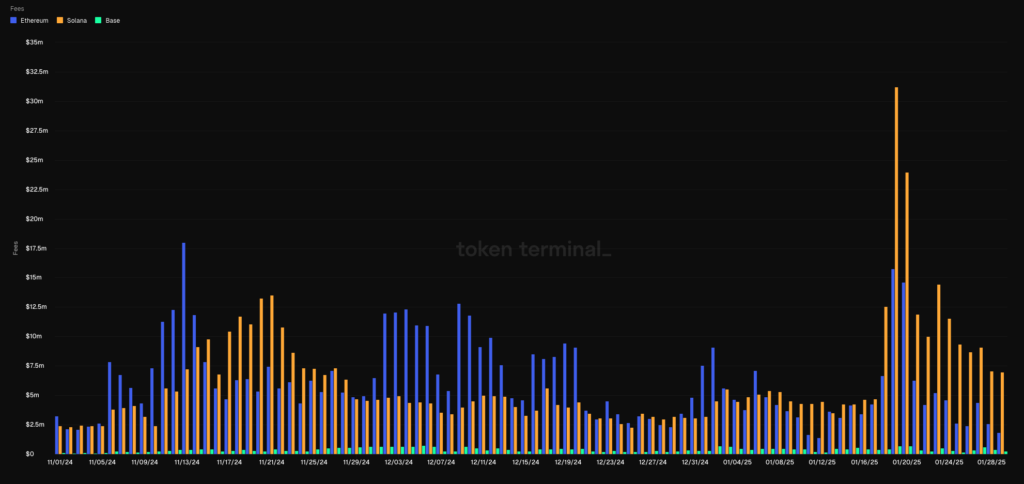

Solana’s daily fee revenue is starting to grow, recently surpassing Ethereum on a daily basis. Much of this is being driven by a massive increase in trading activity given the current memecoin/AI token craze. Traders are absolutely utilizing the network and its decentralized exchanges such as Radium and Jupiter to speculate on the millions of tokens being created by the pump.fun launchpad. It’s TBD whether this is sustainable over time as inevitably trading activity will ebb and flow, but for this cycle, and at this stage, there’s reason to believe it can continue for a while.

Solana fee revenue for the month of January was $245 million, +1,400% y/y.

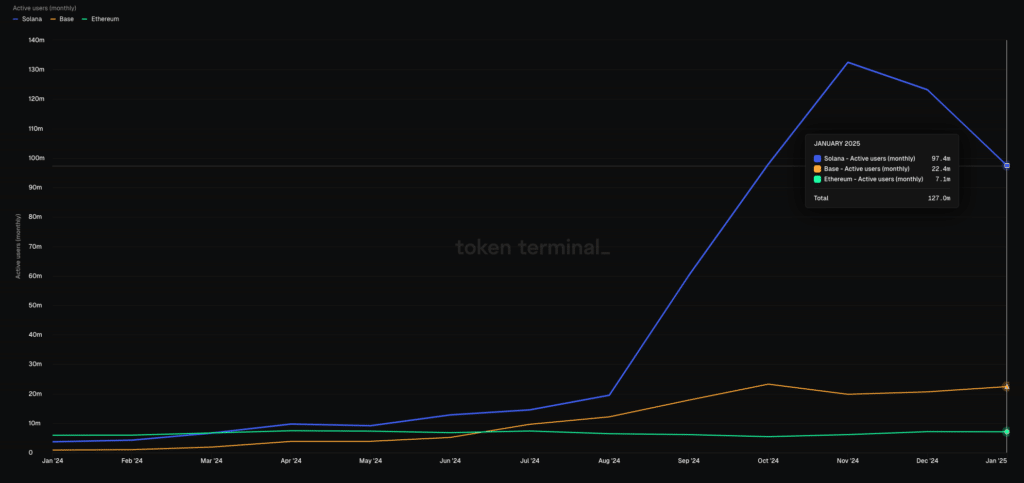

Fee revenue is up as more users flock to the network, many for the first time.

Solana monthly active users have reached almost 100 million for the month of January.

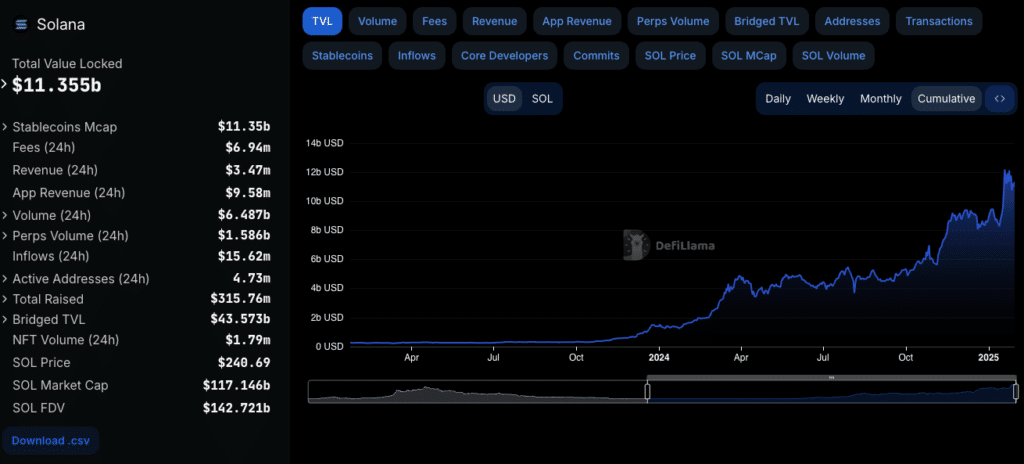

While TVL has also grown from 1.5 billion in 2024 to over 11 billion today, an almost 700% jump y/y.

Again, this surge in activity has largely been driven by a recent increase in trading on the network, which naturally will be cyclical over time. It’s yet to be seen, but if current levels are maintained in the short-term, I think SOL could close some of the market cap gap with ETH.

We also covered Solana in more detail on the tastycrypto show with Katie this week. If you missed us live, watch it on demand here.

What Else Is Real?

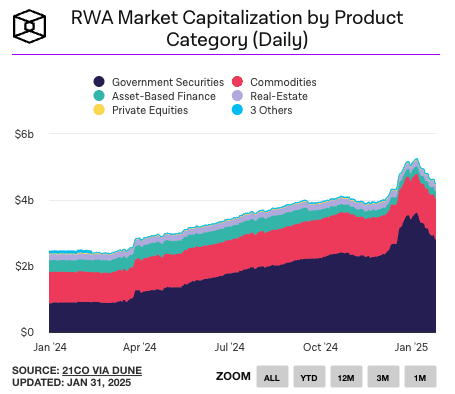

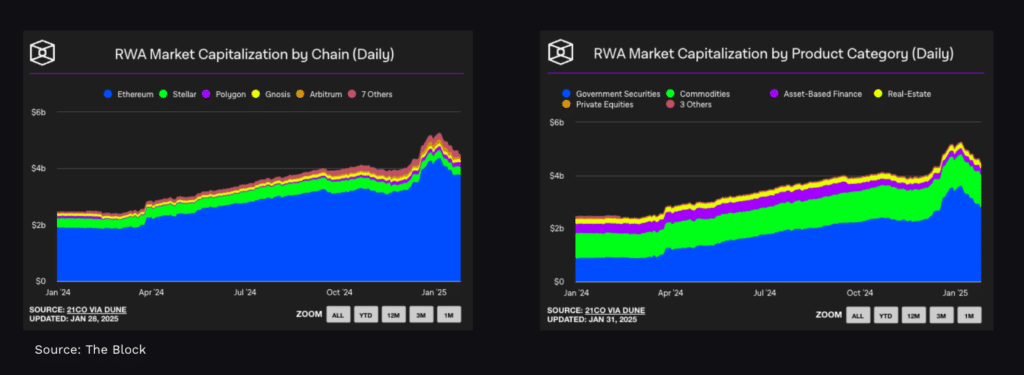

Aside from Solana’s huge jump in activity, another recent theme in the market has been increasing institutional adoption and the growth of real world assets (RWAs). Given the shifting regulatory environment post-Trump, it seems increasingly likely financial institutions will accelerate their embrace of blockchain, with a push to tokenize more traditional financial assets, in turn increasing liquidity on chain.

What Are Real-World Assets (RWAs)?

RWAs refer to traditional financial assets such as stocks, bonds, commodities, and real estate that are tokenized and represented on a blockchain. Tokenizing traditional financial assets enables fractional ownership, and can lead to greater liquidity, and enhanced transparency.

Today, the most prominent RWA on-chain is the US dollar in the form of stablecoins like USDT and USDC. We’re also starting to see some government securities move on-chain in the form of tokenized money market funds, as more investors are looking for opportunities to generate yield while remaining on-chain.

It’s still early, but with people like Larry Fink calling for tokenizing all stocks and bonds, it’s likely we see more assets represented on-chain in the not so distant future.

Shelley and I covered the RWA theme on the tastycrypto show this week and one of the key players we discussed is Ondo Finance and its relationship with BlackRock.

Ondo Finance & BlackRock’s Role in RWAs

Ondo is a platform for tokenizing real world assets and its flagship product, the Ondo Short-Term Government Treasuries Token (OUSG), allows institutional investors to park cash and earn yield across multiple blockchains. Qualified investors can purchase the token which then invests in BlackRock’s USD Institutional Digital Liquidity Fund (BUIDL), which generates yield through a portfolio of short-term US treasury bonds, all directly on-chain.

How To Participate

Beyond stable coins, many real world assets on-chain are only available to institutional investors or qualified participants. As this market matures, likely following regulatory developments, I think it’s likely we’ll see more retail focused offerings, but for now there are ways to gain exposure to the theme itself, by owning the tokens associated with the platforms powering RWA tokenization.

For example, investors can access ONDO via a self-custody wallet like tastycrypto or on a decentralized exchange like Uniswap.

What else to know?

Ethereum dominates RWA adoption, with most tokenized assets deployed on Ethereum’s network due to its security and decentralized infrastructure.

The RWA market remains small (~$38B market cap) compared to the broader financial system, but institutional adoption is driving rapid growth.

RWAs are expected to unlock trillions in value, as regulatory clarity improves and more traditional assets move on-chain.

Analytics platforms like Defi Llama and The Block show increasing capital inflows into RWA projects, signaling that this sector is becoming a larger part of the crypto economy.

The rise of RWAs represents a significant development in crypto, a real use case (if you will) offering real utility and bridging the gap between our existing financial system and what’s happening on-chain.

Another Week In the Books

Looking ahead, crypto markets should remain tethered to traditional assets, at least in the short-term, which means markets could stay choppy as we digest the recent Trump tariff announcements and any other policy changes

As expected there was no change to interest rates following the FOMC meeting this week and generally speaking we’re in a growth up, inflation up, macroeconomic environment, which has historically been positive for bitcoin and other long duration tech assets. We know this can all change quite quickly, but for now, focus on the big picture, secular bullish trend, and try not to get too distracted by the headline noise.

Stay tasty,

Ryan

Web3 Word of the Week (W3WOW)

Show Highlights

- ETH – dead or asleep?

- Solana checking boxes ✅✅✅ and BACK at tastytrade!

- Who’s got hobbies?

- 💩 is getting real on chain