Author: Ryan Grace

December 21, 2024

Good morning my tasty friends, I hope you’re all having a wonderful start to the weekend.

We’ve got a fat sack packed with goodies for you this week. This is the final tastycrypto newsletter of 2024 and it’s the holidays after all.

I’m not going to bore you with a year in review (obviously it was like the best year ever). Instead, let’s lock in and look ahead, crypto’s potential energy is growing with catalysts galore that could set prices in motion.

The market is catching some tailwinds and it’s quickly becoming airdrop season – there’s free money to be had, if you know where to find it. We’re also going to hit on emerging market themes and of course a bit on what’s next for crypto at tasty.

When I asked ChatGPT to summarize what we’re working on, it actually replied. “We’re in the lab whipping up something fire for the streets.”

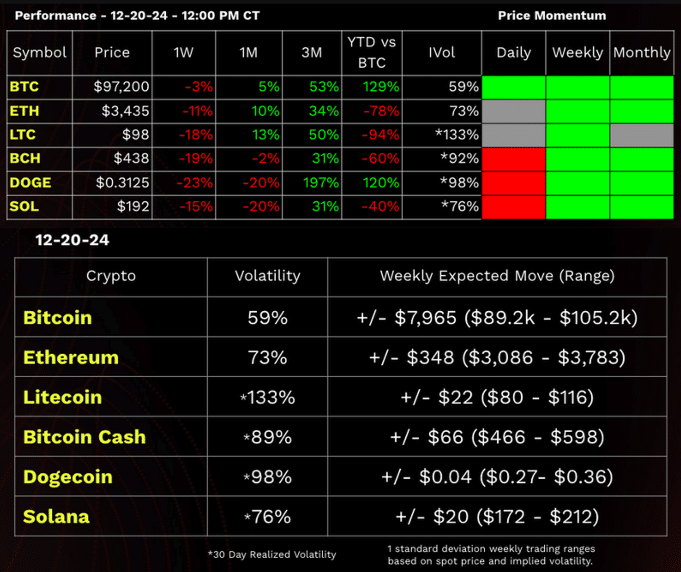

But first… Let’s take a quick look at the performance dashboard.

Performance Dashboard

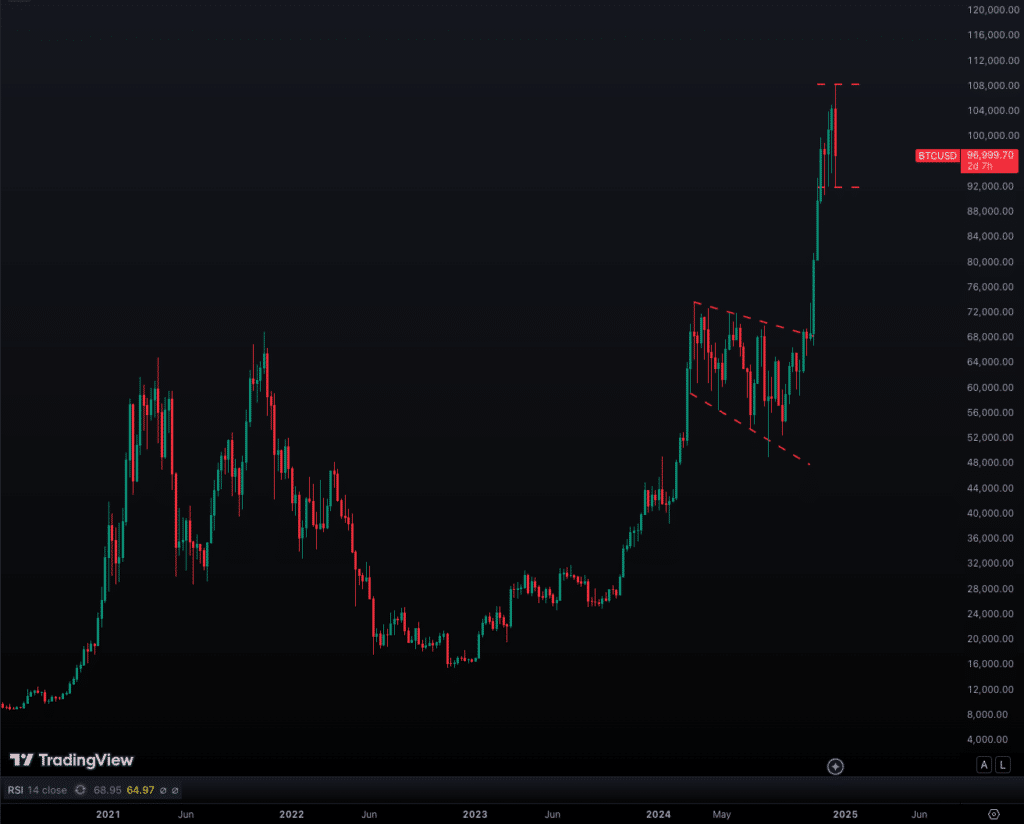

Can I Buy That Dip?

The coins move quickly, three days ago the price of bitcoin was $108,000, then suddenly we are back in the low 90s again!

To put things in perspective, markets from crypto to the S&P 500 have basically been going up every single day for most of December, so inevitably we’d get a correction, which often sees prices pushed to the low end of their recent ranges.

What caused it? Well, Jerome Danger of course and his gang of Federal Reserve governors.

They just caught up to inflation reaccelerating and are apparently in less of a rush to cut rates as quickly as the market was expecting. This was enough to spook risk assets across the board, with equity vol exploding to the upside ahead of a sizable options expiration. Risk happens fast and crypto was no exception. But has the trend changed?

No, the trend has not changed. BTC +50% 3-month is a bullish trend.

Volatility is rising. Do we freak out, do we trade it differently?

No, we do not freak out.

The approach has always been the same. Manage that risk.

Buy a little at the bottom of the range and sell a little at the top. Repeat. Use the estimated ranges we post which are calculated off the spot price and current implied volatility. Stay on the right side of the trend. If the momentum signal breaks down and we go from bullish to bearish. GTFO.

For some added color, here’s what I shared with my team on the desk on Thursday:

Structurally this is still a bullish trend and typically you want to buy the low end of the range within the bullish trend. That said, the ranges are dynamic and are a function of current spot price and implied volatility. Sure, you can always get caught in a transition between a bullish to bearish trend, but I’m not really seeing any signs of that currently.

No real change in the implied volatility of ETH or BTC today either, even with this move. – No signs of the market freaking out and bidding downside insurance (put options). – If BTC implied vol was moving higher, it would be a signal.

This is also a macroeconomic environment where both the rate of change of growth and inflation within the economy are accelerating to the upside, this has historically been a good macro setup for bitcoin and commodity prices.

We have ascended from the pit of darkness. A new dawn is upon us.

I think we’ll look back on 2024 as the year crypto went fully mainstream. We started with bitcoin ETF approvals and ended with a pro-crypto President-elect. In between, the price of bitcoin reached $100,000 for the first time, ETH ETFs were approved, crypto options launched, and following the election, Gary Gensler resigned as chairman of the SEC.

I’ve been involved in crypto markets for a decade and I’ve seen some things. I’ve questioned my sanity and even contemplated quitting. Now, I’ve never been more excited.

Drinks up. What's next?

For 2025 of course we’re going full blown pedal to the floor, big ass flows, blast off mode for tastycrypto. Strap in.

We’re launching new shows, new products, and new experiences, starting with a live morning show streaming on the tastycrypto YouTube channel.

Shelley’s getting her own show and you’ll be seeing more of Laurence on-air too. If you’re not subscribed to the tc YouTube channel, NOW IS YOUR CHANCE, get your subscription on.

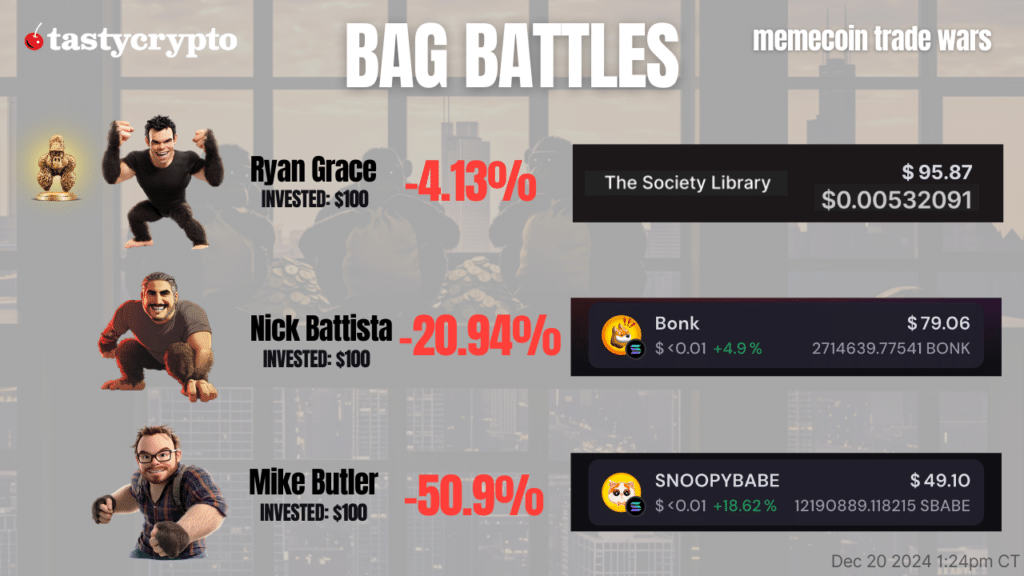

BAG BATTLES (where we throw real money at memecoins each week) is getting crazier with more money and more traders, plus we’ve got a new defi mini-series rolling off the production line.

On the product side, we’re adding blockchain networks to the wallet, expanding access to defi, and building more crypto services at tasty. Imagine… Stablecoin support, NFTs, hell… Maybe a tasty token. I hear tastytrade might be adding more coins too.

Free Money

If you’ve perused crypto Twitter at all recently, you’ve probably seen people talking about free tokens they’ve received in the form of an airdrop. For my normies, an airdrop is a unique crypto concept where free tokens are sent to wallet users.

It’s kind of like spam, but instead of annoying messages in your inbox, you get free tokens—which often translates to free money.

A drop that has the market’s attention this week is the Pudgy Penguins PENGU token. Pudgy Penguins is an NFT collection of adorable penguin avatars that’s gained popularity, in part due to its engaging community of holders.

Web3 Word of the Week (W3WOW)

Recently, the project launched a token called PENGU, with part of the supply going to both Pudgy Penguin NFT holders and also early users of both the Ethereum and Solana blockchains. Yours truly received some PENGU in his wallet, not because I’m part of the Pudgy community, but simply because I was an early user of Solana. I received 1,837 PENGU tokens, which has a current market value of $48.89. Party money.

A small reward for simply being an early participant in the crypto ecosystem is a powerful incentive mechanism. The perceived potential of an airdrop drives engagement and I think we’ll likely see more traditional brands and businesses adopt these tactics as the world moves further on-chain.

NFT communities and airdrops will be as commonplace for brands as email marketing is today.

A History of Drops

It’s still early days for crypto adoption and we’re barely scratching the surface of on-chain marketing, but airdrops have been part of crypto since the beginning.

The concept gained traction in 2014 when the AuroraCoin project airdropped its cryptocurrency to Icelandic citizens as a statement against centralized monetary systems. Airdrops were then further popularized on Ethereum during the 2017 ICO boom. 0x, the decentralized exchange aggregator is a notable example from this time.

When 0x’s ZRX token was launched, 5% of ZRX tokens were distributed to Ethereum wallet addresses that had interacted with the Ethereum blockchain before the snapshot date, ensuring the tokens were distributed to active users. Today the market cap of the ZRX token is $457 million and the total value of the tokens given away in the airdrop is around $20 million. Party money!

For many crypto projects, airdrops are a marketing strategy to generate hype and attract users which in turn creates a network effect, and can lead to a higher likelihood of recipients using the project’s app or services. I’m all for free money and engagement farming, but despite their popularity, airdrops have their critics.

One major complaint is the potential for misuse; airdrops often attract opportunistic participants who have no interest in the project itself. These recipients simply dump the tokens as soon as they get them which can create a lot of volatility. For projects, this creates a challenge: balancing the need to attract users with ensuring the tokens are distributed to people who genuinely believe in and will support the project.

Fine with me, let the market sort it out.

I want free stuff.

In my experience, any airdrop I’ve received has come as a surprise, but there are sites you can use to stay on top of potential drops. Here’s an article from CoinGecko for example.

Many airdrops reward users for holding a particular cryptocurrency, using a platform, or participating in governance. To qualify, you might need to connect your wallet to a project’s website, interact with an app, or simply hold specific tokens in your wallet during a snapshot period. Some projects also reward users for completing tasks, like following them on X or sharing content.

Just remember to exercise caution when connecting wallets to unfamiliar platforms and signing transactions. If you don’t know what or who you’re interacting with, be careful, there’s still a lot of risk of fraud in crypto. It’s getting better, but you’re in open waters and there are pirate ships.

2025 Themes

In no particular order, here’s a few themes on my radar as we head into next year.

Growth of Layer 2 scaling solutions. L2 TVL has increased 200% to $50 billion over the past year.

Crypto AI Agents. AI programs integrated with blockchain technology are reshaping how tasks are executed on-chain. Ai16z (AI16Z) and the Virtuals protocol (VIRTUAL) are two early examples of AI on-chain.

Real World Assets (RWAs). Large financial institutions explore blockchain solutions to increase efficiency, transparency, and accessibility in traditional markets. Projects like ONDO, Goldfinch, and Maple Finance, are pioneering on-chain RWAs like money market funds and credit instruments.

Crypto ETFs. We hope to see a Solana ETF approval and possibly ETH ETF staking dividends. Both would likely bring additional capital flows into the market and support continued institutional adoption.

The evolution of DePIN (Decentralized Physical Infrastructure Networks). Networks that tokenize physical infrastructure like wireless networks (Helium, HNT) or storage systems (Filecoin, FIL) bring real-world utility to crypto by incentivizing participants to support infrastructure development and maintenance.

Regulatory clarity. Clear regulations are presumably coming and will also support adoption and increased market participation. Rules for US companies will bring more development activity and users to blockchain applications.

More money, more memes. I suspect stablecoin usage will grow, especially on Solana and ETH L2s as new users trade meme coins and other tokens on decentralized exchanges for the first time.

These are a few of the areas I’m focused on, but Laurence, our head of business at tastycrypto and my mate in London has also shared some links too. Please find some 2025 outlooks from a few more crypto outlets below.

Thanks <3

As I reflect on 2024, it’s hard to believe it’s only been a year. Given the 24/7 nature of crypto markets, it seems a lot longer. Across the tasty companies (crypto, trade, live) we’ve made a ton of progress, but at the same time we’re just getting started. I’m super proud of our team and everyone across the business involved with getting tasty’s crypto offering to where it is today. I don’t know if anyone else at this company reads these notes, but if they do, thank you.

Thank you to tastynation for your constant support and feedback as we work to build the best crypto products and services for the tastytrade community.

And to the thousands of you that read this email each week. Thank you.

Take profits when you got em and keep your head on a swivel.

Stay tasty,

Ryan

This Week's Show Highlights

- Why we all need to stock up on tin foil

- Quantum hacking is imminent… what will happen to crypto?

Next:

HAPPY HOLIDAYS!

- The tastycrypto Show with Ryan & Guests will resume on 12/30/2024

- BAG BATTLES will be back on Monday, January 6th at 11am CT

- NEW SHOW coming to our tastycrypto channels on Tuesdays and Thursdays at 8:30 am CT