Author: Ryan Grace

November 23, 2024

Good morning my tasty friends. I hope you are all having a wonderful start to the weekend.

Bitcoin is clocking all-time highs on the daily, the bullish headlines keep hitting, and there’s a slight sense of euphoria in the market. Does it get any more tasty than this?

Naturally questions arise.

“Should I sell?”

“It’s going to pull back, right?”

“It can’t keep going up, right?”

“Right??”

”RIGHT!!!”

It’s true, there’s no better price to sell than an all time high. This was true yesterday too.

I started writing this on Thursday and I’ve since taken a tiny bit of my stack off the table at 98, a little party money, if you will. I’ll add on a pull-back (down 10%), but who knows, maybe it never pulls back. I have no idea what IT is going to do.

What I do know is this is largely an exercise in risk management. Try not to get too emotional.

The trend is bullish. Buy the dips, sell the rips, identify when it changes. Sounds easy, right?

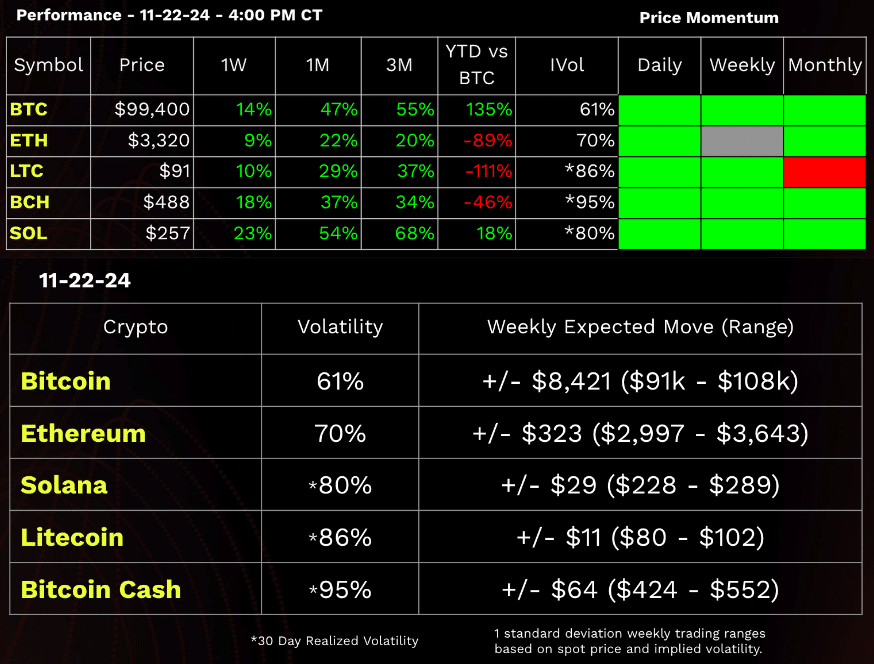

Performance Dashboard

There’s been more bullish headlines than I can count this week and we’ve got the content pump on full blast over on the tastylive network (shoutout to Katie, Nick, and Mike). We’ll get to all of that in a sec, but first… Performance Dashboard below.

What a week. Where should we start?

The numbers on the screen are getting pretty big. It feels good, but uncharted territory invites uncertainty. Or maybe fear.

“What if I sell and it goes higher?”

“What if it sells off like last time?”

“Should I take profits?”

“Do I own enough?”

Here’s how I think about it. Let the volatility be your guide and trade the range inside the trend.

At the time of writing, the weekly bitcoin expected move is almost 10k. 10k is a stack. It’s a lot of money, but for a roughly six-figure asset, it’s a 10% move. Totally normal.

This can and will change, it’s fluid, this living organism of a market, but for now we can use the range to illustrate the concept.

Point being, take a little off the table at the top of the range. If you’re still bullish at the bottom of the range, buy a little back.

Maybe the weekly range holds each time, maybe it doesn’t (statistically it should be close to 60%). Regardless, it’s an approach that helps me manage risk, constrain the urge to chase, and book some profit at times, and last time I checked, no one ever went broke taking profits.

Other quick thoughts:

$100,000 is just a number.

Recognize the market you’re in. Vol is picking up. This means bigger ranges. Be patient and size positions accordingly. Bitcoin could go to 75k or 125k in weeks and it wouldn’t be out of the ordinary.

Have fun.

Bitcoin Options Now Available For Trading

When we first heard the beautiful news of the bitcoin ETF approvals, most of us here at tasty immediately jumped to “when will options start trading?” Well, the time is now.

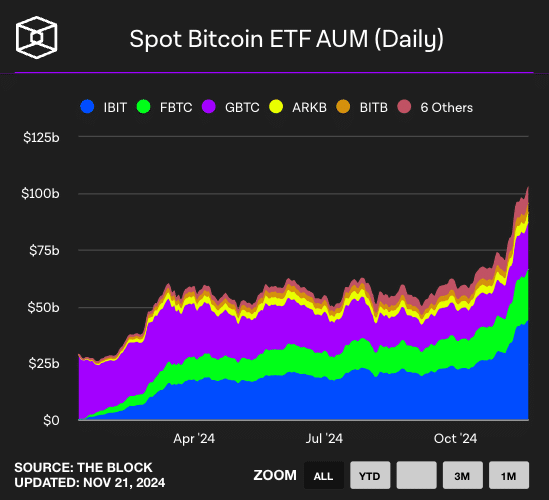

Options were listed for multiple bitcoin ETFs this week, with Blackrock’s IBIT leading the way at $1.9 billion in options trading volume on its first day (some are saying this is unprecedented).

For context, the prior launch of options on the bitcoin futures ETF (BITO) saw $363 million in volume day-1.

Options represent a major milestone in crypto’s integration with mainstream finance as they offer investors ways to hedge risk, speculate with leverage, and deploy different trading strategies.

I for one am looking forward to selling upside volatility, should Bitcoin implied vol expand and call option premiums increase.

You can trade these options in the tastytrade platforms on the Trade tab for each of the different ETFs, and if you don’t use tastytrade currently, you can learn more here (https://tastytrade.com/).

To date, options trading is available on IBIT, the ARK 21Shares Bitcoin ETF (ARKB) and the Fidelity Wise Origin Bitcoin Fund (FBTC). Presumably more are coming, and maybe even options on ETH ETFs sometime next year. That’d be tasty.

Oh and by the way, BAF ALERT!!! (Big Ass Flows)

There’s now over $100 billion in AUM held by Bitcoin ETFs.

Crypto Industry Catching Ws

Gensler Resigns

SEC Chairman Gary Gensler announced he will step down from his position effective Jan 20, days ahead of President-elect Donald Trump’s inauguration.

This shouldn’t come as a surprise, given the historical precedent for SEC chairs transitioning during changes in administration, but cheers could be heard across the industry when this headline hit.

Under Chair Gensler’s leadership the SEC’s war against the crypto industry has stifled innovation and entrepreneurship in the US through its consistent enforcement actions against US crypto firms and unwillingness to work with the industry in any constructive capacity.

The war is over. Right?

DeFi Traders Are Not Broker-Dealers

Down in the great state of Texas a federal judge just ruled against the SEC’s controversial attempt to expand existing securities laws to encompass (DeFi) decentralized finance projects and users.

In short, the judge determined the SEC’s reinterpretation of the “dealer rule” and its effort to treat DeFi protocols as securities exchanges and brokers, meant the SEC had exceeded its authority, essentially saying DeFi protocols are not securities exchanges.

On the surface this might seem like a minor development but it’s a win for decentralized finance and the crypto industry, in terms of added regulatory clarity.

Is SOL the Next Market Darling?

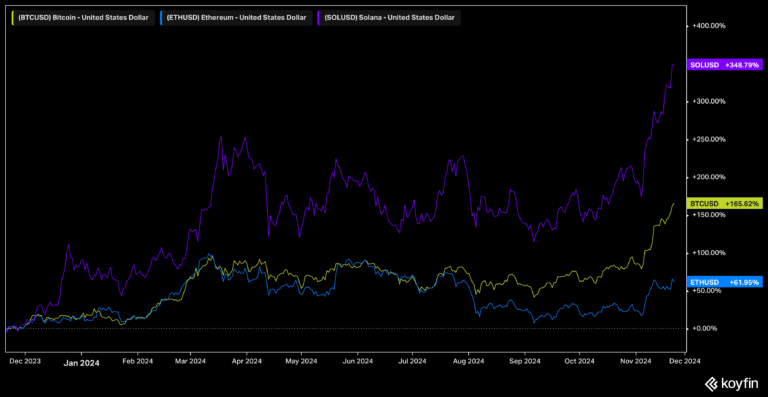

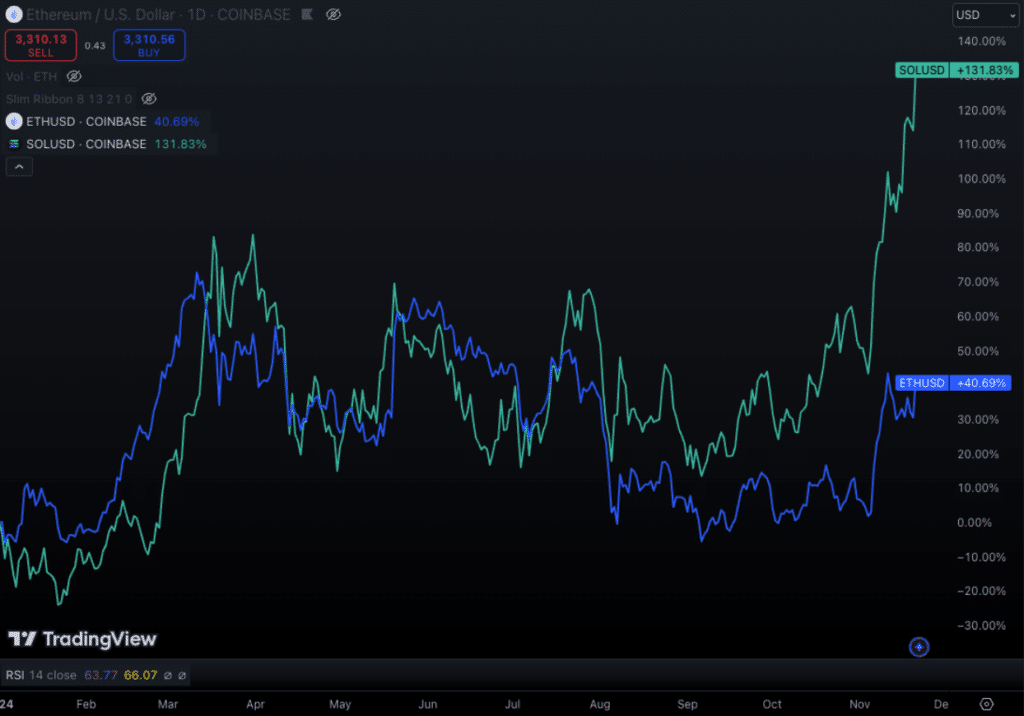

Obviously everyone’s attention is on bitcoin blast off mode and the 100k number, but even up 50% in the last month, it’s underperforming.

Yes, it is underperforming Solana.

Now, I love all the crypto in my family equally, but I think there’s a chance SOL could be the market’s next favorite child.

Solana (SOL) hit a new ATH at $262 this week. Its price is up a silly amount from the “crypto is dead, FTX collapse” lows, but if we just use the year-to-date performance, it’s +150% vs BTC at 130%.

Over the past year, SOL has gained 342%.

Silly performance, and now a $120 billion market cap asset the market might start taking a lot more seriously. Especially, if institutions can buy it via an ETF.

Asset managers, including VanEck, 21Shares, Canary Capital, and Bitwise, have all submitted S-1 filings for spot Solana ETFs and reportedly exchanges such as Cboe may soon file 19b-4 forms, a critical step for SEC approval of these ETFs.

If approved, this removes regulatory ambiguity and opens the door to potential institutional investment in the asset.

Why would institutions invest in SOL?

Solana has long been billed as an “ETH Killer” as it functionally does many of the same things as the Ethereum network (arguably better in some cases).

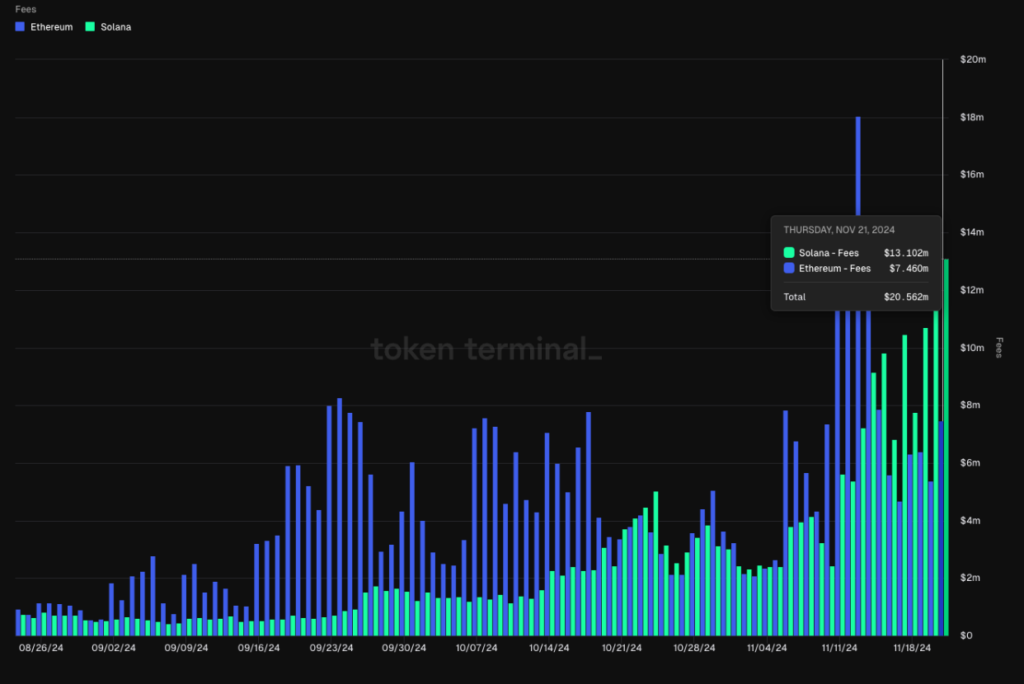

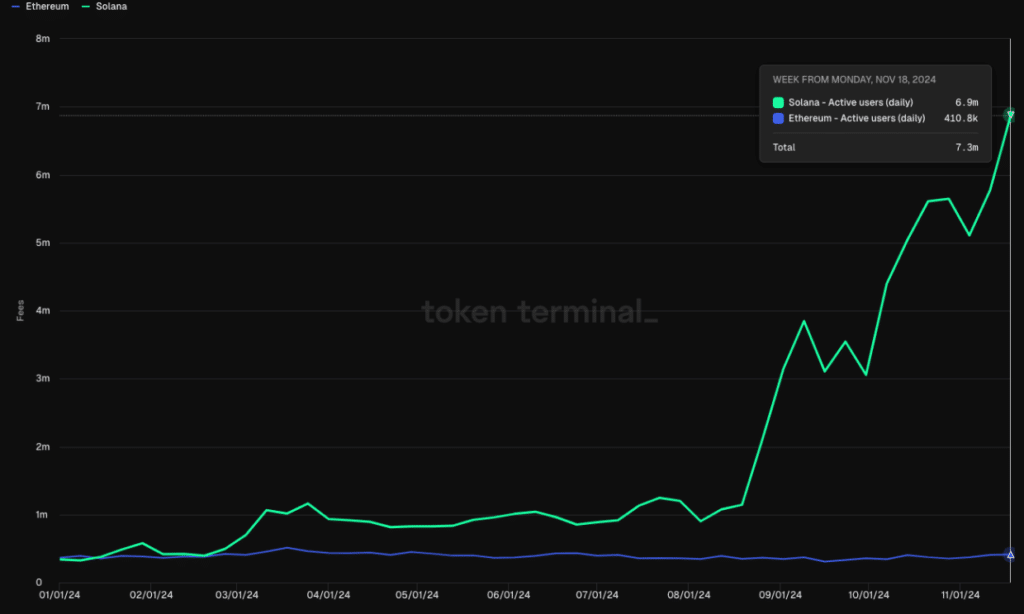

On-chain, SOL is starting to put up ETH numbers, at least in terms of volumes, users, and fee revenue.

Assets on the Solana network are nowhere near ETH, with only $9 billion in TVL compared to ETH’s $63 billion, but there are encouraging signs regardless.

Fundamentally, Solana as a network is showing promising growth, but up to now, Solana as an investment has been clouded in uncertainty.

This stems from concerns its native token, SOL, could be classified as a security under U.S. law. For over a year, these concerns have been amplified by the scrutiny the SEC has placed on various crypto assets, labeling several as unregistered securities in lawsuits against exchanges like Coinbase and Binance.

While Solana itself was not explicitly targeted, its inclusion in discussions about potentially unregistered securities has likely kept larger institutional investors at bay.

This could all change, should a SOL ETF gain approval for trading.

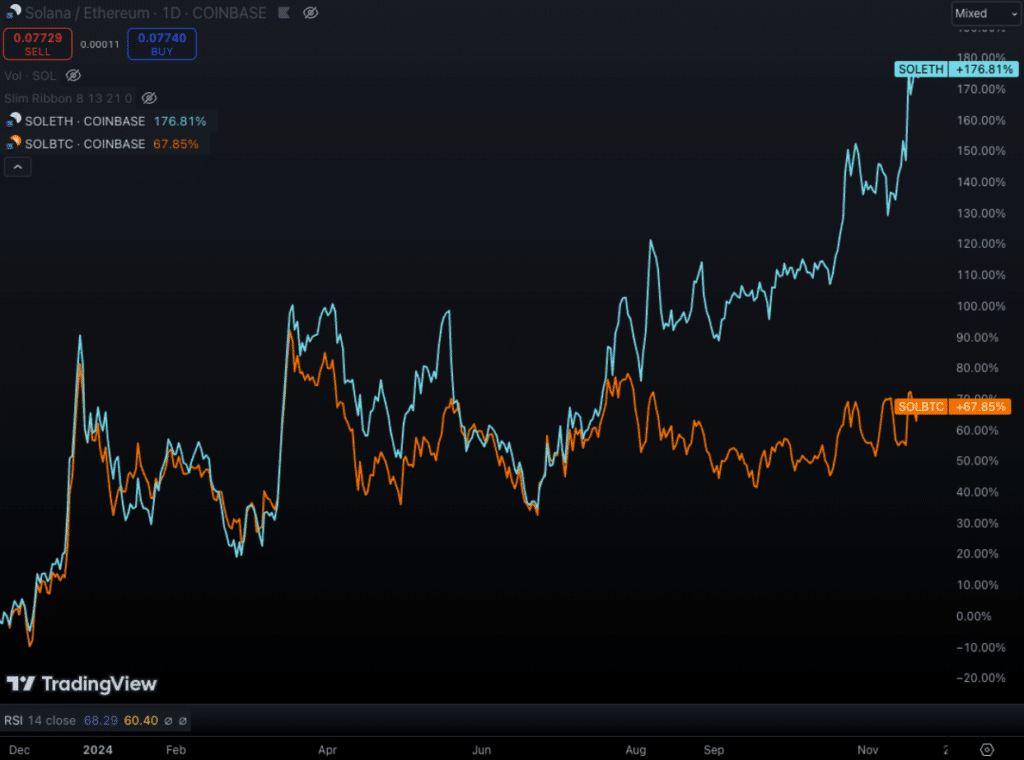

If this happens, given the positive fundamental backdrop, you could then see the market cap gap between SOL and ETH narrow quite a bit more. This is not to say I’m bearish on ETH, more so I think there’s an opportunity for continued SOL outperformance on a relative basis.

Some Solana and Ethereum related charts I’m watching below:

YTD Performance

Market Cap

Solana vs ETH, BTC

tastycrypto Show Highlights

- How big are your BAGS? (or baggies 😅)

- Ryan answers the question: WHY invest in Bitcoin?

- 👀 Spot the difference?

- Quantum physics x memecoins is making too much sense.

Next:

Episode 4 – Where Do I Start With Crypto with Katie McGarrigle!

BAG BATTLES – ROUND 1 Memecoin Showdown

Join in the fun and hop in the live chat during the show!