PulseX is a decentralized exchange on PulseChain for PRC20 token swaps, featuring the native PLSX token, high TVL, and a burn mechanism. However, the platform is marred by founder Richard Heart’s controversies.

Written by: Anatol Antonovici | Updated July 10nd, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Table of Contents

🍒 tasty takeaways

PulseX is a DEX for PulseChain, a layer 1 blockchain derived from an Ethereum fork.

PLSX is the native token of the PulseX exchange, which launched following a “sacrifice” event that raised over $1 billion.

PulseX and PulseChain have many red flags due to the controversial nature of their founder.

PulseX: Live Price

PulseX: Live Chart

What Is PulseX?

PulseX is a decentralized exchange (DEX) platform for swapping tokens on PulseChain, a layer 1 blockchain.

It works as an automated market maker (AMM), relying on the same principles and mechanisms as the popular Uniswap DEX. In fact, PulseX is a fork of Uniswap, meaning that it copied its code and AMM mechanism.

PulseX facilitates the trading of tokens using the so-called PRC20 standard, which mimics Ethereum’s ERC-20 standard.

PulseX TVL Performance

PulseX launched in May 2023, and its total value locked (TVL) set a record high within a few days, almost touching $500 million. Following a multi-month consolidation period, the TVL spiked again in March 2024 to over $465 million amid record trading volumes of over $150 million.

Source: DeFiLlama

What Is the PulseX Token?

Like Uniswap’s UNI, PulseX has its native PRC20 token with the ticker PLSX.

Users who provide liquidity on PulseX’s pools receive rewards paid in PLSX.

Part of the fees paid by PulseX traders is used to buy back PLSX and then burn it, a move meant to support the token’s value in the long term.

PulseX’s token has a total supply of 143.09 trillion tokens. The reported circulating supply is 142 trillion tokens, which is gradually declining due to the burn mechanism. So far, about 0.64% has been burned since its launch in 2023.

PLSX Performance

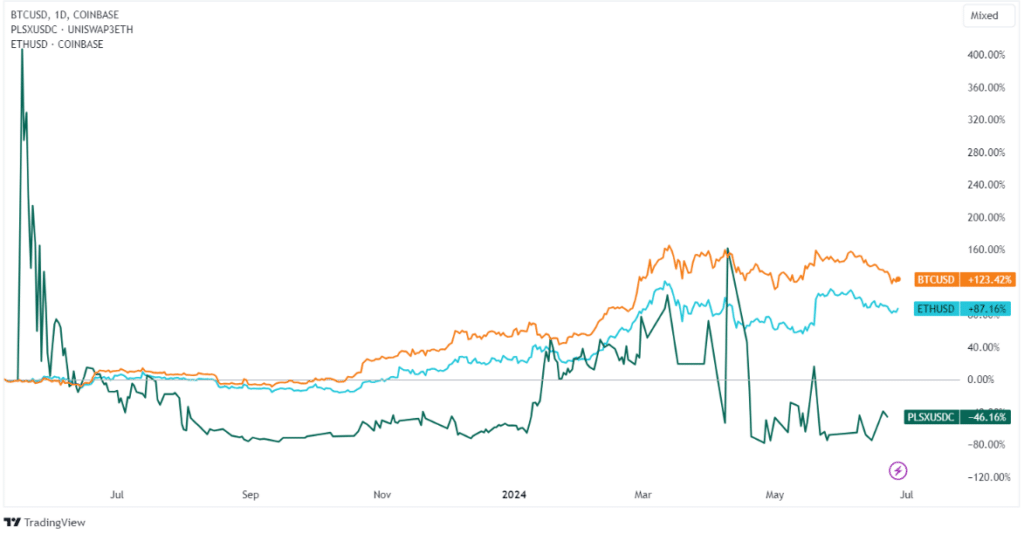

The current price of PulseX is $0.00002 as of the end of June 2024, down 36% over the last year.

After reaching an all-time high of $0.0001 shortly after its launch, the PLSX price dropped to an all-time low of $0.0000088 a few months later. While it’s up over 140% from that low, it hasn’t been able to keep up with the broader cryptocurrency market, underperforming against Bitcoin (BTC) and Ethereum (ETH).

Source: TradingView

What Is the Goal of PulseX?

The goal of PulseX is to act as the go-to DEX for the PulseChain ecosystem and its PRC20 tokens.

It is currently the largest decentralized finance (DeFi) app on PulseChain, accounting for over 70% of the network’s TVL, as per DefiLlama.

How Does PulseX Work?

PulseX is a DEX for PulseChain, supporting the following operations:

- PRC20 token swaps.

- Liquidity provision for the platform’s liquidity pools representing token pairs. Liquidity providers earn PLSX rewards from the fees paid by traders.

- Yield farming – liquidity providers receive LP tokens confirming their pool deposits. These tokens can be staked for additional yield, with the annual percentage rate (APR) ranging from 14% to over 70%. The rewards are paid in Incentive (INC), a second native token for the PulseX ecosystem.

The platform charges a 0.29% fee for every swap, compared to Uniswap’s standard fee of 0.3%.

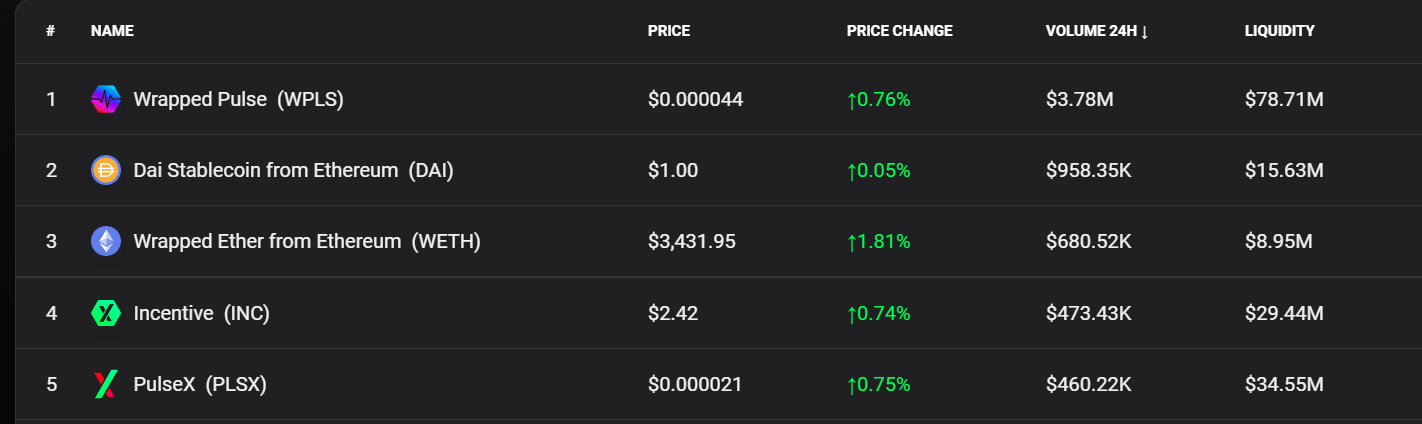

The most liquid tokens on PulseX include Wrapped Pulse (WPLS), Dai Stablecoin from Ethereum (DAI), Wrapped Ether from Ethereum (WETH), INC, and PLSX.

Source: PulseX

What Is PulseChain?

PulseChain is a layer 1 blockchain launched in 2022. It represents a fork of Ethereum, aiming to be an improved version of it.

Both PulseX and PulseChain are the brainchildren of Richard Heart, the founder of HEX, which promotes itself as the first blockchain certificate of deposit (CD) token. HEX has been around since 2019 and pledges high yield figures for staking the token.

What Does PulseChain Try to Achieve?

While several major blockchains compete with Ethereum regarding scalability and efficiency, such as Solana or Avalanche, PulseChain was designed to achieve improved performance by forking Ethereum with its entire ecosystem.

Essentially, Pulsechain took a snapshot of the Ethereum system state and mirrored it on a newly developed network with additional modifications.

What Is the PulseChain Token?

The PulseChain token (PLS) is the blockchain’s native token. It is used to participate in the consensus mechanism, pay transaction fees, and bridge to other chains.

Starting in 2022, users could participate in a so-called ‘sacrifice phase,’ in which they could donate cryptocurrencies and fiat currencies, such as USD, EUR, GBP, AUD, or JPY, to indicated addresses. While this was not a direct investment, the more they sacrificed, the more PLS they could expect.

In February 2022, PulseChain rose over $1 billion during the first months of its ‘sacrifice’ event, becoming one of the biggest funding rounds in crypto history. Unofficial data from 2023 reports over $13.7 billion raised.

What Is the PulseChain Controversy?

Many crypto investors are concerned that the PulseChain and PulseX ecosystems are suspicious if not outright scams.

PulseChain, PulseX, and HEX could represent Richard Heart’s Bermuda Triangle of a massive rug pull.

Here are some of the reasons why the crypto community is worried:

- Richard Heart, whose real name is Richard Schueler, has been promoting himself as an entrepreneur and author. However, he has been surrounded by controversies. In 2002, he was accused of being involved in a spam-related scheme.

In 2023, the US Securities and Exchange Commission (SEC) charged Richard Heart with conducting an unregistered offering of crypto securities, raising $1 billion from investors, and misappropriating millions of US dollars to buy luxury goods for personal use.

Heart allegedly used the “sacrifice” approach to raise crypto funds while trying to evade US securities laws.

In January 2024, while in Finland, he hired top lawyers to fight the SEC allegations. The news triggered a bull run of all three coins, PLSX, PLS, and HEX, but eventually, the recovery attempt was unsuccessful. - Following its launch, PulseChain was flooded with bugs and technical issues, such as exaggerated fees, the price deviation of Wrapped Bitcoin, or a bug that prevented PulseX liquidity providers from earning rewards.

While PulseX and PulseChain are operational crypto products, crypto investors should know their risks.

FAQs

What is PulseX?

PulseX is a decentralized exchange (DEX) on the PulseChain blockchain, which is a fork of Ethereum. It was designed as an automated market maker (AMM) similar to Uniswap, specifically for swapping PRC20 tokens. The DEX is fueled by its native token, PLSX.

What is PulseChain?

PulseChain is a layer 1 chain launched in 2022 as an improved version of Ethereum. It aims to offer better performance than Ethereum.

Where can I buy PulseX tokens?

The PLSX token can only be purchased on the PulseX exchange and Phux, another decentralized exchange on PulseChain.

Is it worth investing in PulseX?

Investing in PulseX carries major risks, considering the controversies surrounding its founder, Richard Heart, and technical issues with the blockchain.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com