A DeFi (decentralized finance) wallet is a self-custody crypto wallet that allows users to store cryptocurrency and connect to decentralized applications.

Written by: Anatol Antonovici | Updated August 25, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

Web3 DeFi wallets offer easy access to decentralized finance applications and support activities like crypto staking, lending, and liquidity provision. In this guide, we’ll tell you how they work!

🍒 tasty takeaways

Unlike crypto exchanges, DeFi wallets give users full control over their crypto assets.

DeFi wallets act as a gateway to DeFi apps like decentralized exchanges and lending protocols.

DeFi wallets require no KYC verification, ensuring the privacy and security of token holders.

- tastycrypto, Exodus, and Coinbase offer DeFi wallets.

DeFi Wallet Summary

| Description | |

|---|---|

| What is a DeFi Wallet? | A self-custody crypto wallet for storing cryptocurrency and connecting to decentralized apps. |

| How Does It Work? | Through browser extensions, software apps, or digital interfaces. Uses public-key cryptography for security. |

| DeFi vs CeFi | DeFi wallets give full control over assets. CeFi wallets might expose users to risks and lack of control. |

| Top DeFi Wallets | MetaMask, tastycrypto, Coinbase Wallet, Trust Wallet, Crypto.com DeFi Wallet. |

What Is DeFi?

Decentralized Finance (DeFi) is an umbrella term for all digital financial systems and applications built on public blockchains that operate without central intermediaries, aiming to create an open and permissionless financial system in Web3.

Decentralized finance (DeFi) is the most significant trend in cryptocurrency. Bank of America and ING have separately concluded that the DeFi ecosystem is more disruptive than Bitcoin (BTC).

The core concept behind DeFi revolves around creating decentralized financial services that operate independently of centralized organizations and rely solely on open-source code for rule enforcement.

Decentralized applications (dapps) and their smart contracts enable peer-to-peer interactions that eliminate the need for intermediaries. This translates into financial freedom, privacy, no censorship, less room for corruption and misconduct, and a democratic approach.

DeFi and Blockchain

Blockchain is the underlying infrastructure for all of Web3, including DeFi. Blockchain-based activities in DeFi include:

🍒 TradFi vs DeFi – Here’s How They Differ

All interactions in DeFi require decentralized wallets, which we also call DeFi wallets.

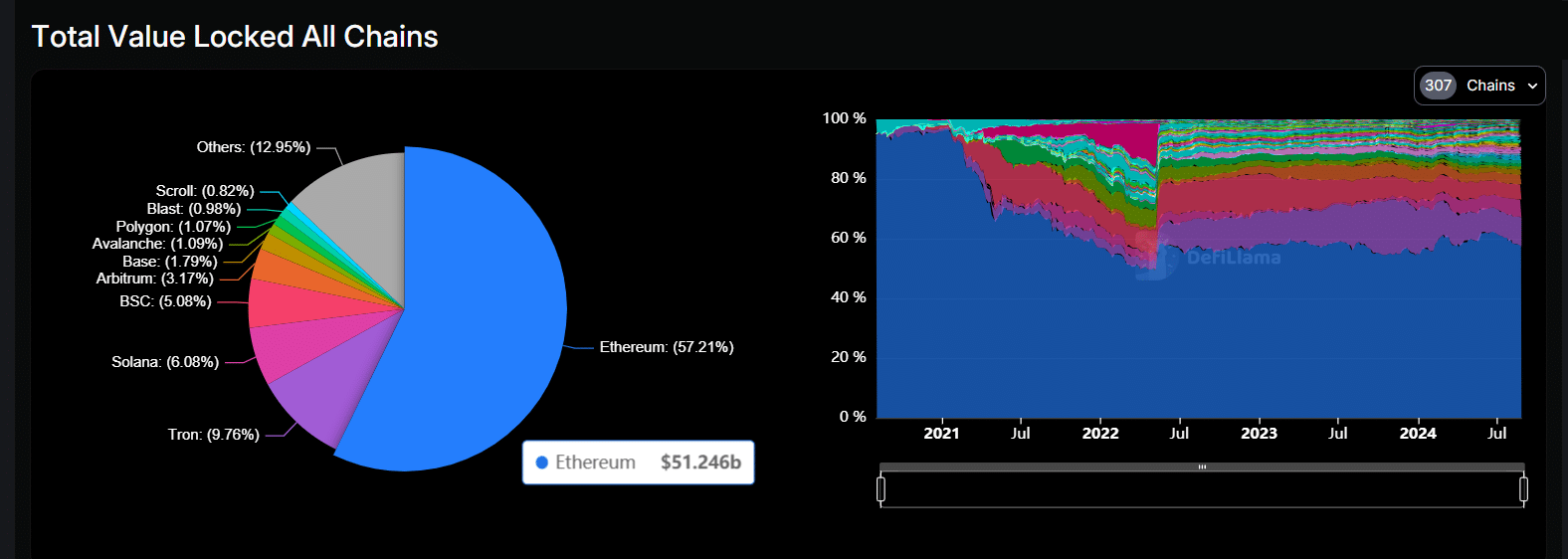

As of August 2024, DeFi is a $90 billion market in terms of total value locked (TVL). Because of its security and wide adaptability, Ethereum (ETH) is the most sought-after network to build these dapps on, as illustrated below.

dApps by Blockchain

Source: DeFiLlama

What Is a DeFi Wallet?

DeFi wallets are cryptocurrency wallets that give users access to DeFi applications. Their main function is to store cryptocurrencies like ERC-20 tokens, stablecoins, and non-fungible tokens (NFTs). They also connect users to Web3 apps in the DeFi space. It is impossible to connect an exchange wallet to Web3 because these wallets do not offer users access to private keys.

DeFi wallets stand out because they offer self-custody, meaning users have complete control over their digital assets. In most cases, this prevents governments, companies, or any centralized entity from freezing or accessing the wallet’s funds.

How Do DeFi Wallets Work?

DeFi wallets can come as:

- Browser extensions

- Desktop apps

- Mobile Apps

- USB Drives

USB drive wallets are also known as hardware wallets, e.g., Ledger and Trezor.

🍒 tastycrypto offers both browser extension and mobile DeFi wallets!

DeFi wallets work by connecting users to blockchains securely.

DeFi Wallet Security

DeFi wallets ensure security and privacy through a cryptographic technique called public-key cryptography.

In this system, users exclusively possess the private key that corresponds to their public key, which is their wallet address. The public key can be shared openly, while the private key is used for authorizing transactions. It’s similar to sharing the 16 digits of a credit/debit card while keeping the PIN confidential.

Most DeFi wallets are multi-chain, supporting networks with the smart contract feature, including mainnets like Ethereum, BNB Chain, Avalanche, and Cosmos, as well as layer 2s like Polygon, Arbitrum, and Optimism.

What Can You Do with a DeFi Wallet?

Accessing DeFi applications requires a non-custodial wallet. Once you have one, you can engage in various activities, including:

- Trade tokens – with a DeFi wallet, you can access DEXs like Uniswap or PancakeSwap to swap tokens. The process is smooth and cheaper than using centralized exchanges (CEXs). There’s no requirement for KYC verification or the need to open an account, unlike most Centralized Exchanges (CEXs). You can trade ERC-20 tokens and other digital assets, excluding cryptocurrencies such as Bitcoin or Litecoin, which operate on separate Proof of Work blockchains. However, there are wrapped tokens designed to mirror BTC, LTC, or other cryptocurrencies, allowing them to be compatible with DeFi platforms. Wrapped ether is the most popular.

- Provide liquidity – In addition to trading on DEXs, you can provide liquidity on DEXs and get paid! DEXs act as automated market makers (AMMs) and rely on smart contract-based pools instead of order books. You can deposit tokens in these liquidity pools to become a liquidity provider (LP) and earn rewards from trading fees.

- Borrow and lend crypto – You can borrow tokens using crypto as collateral and earn passive income on platforms like Aave, Compound, and Maker.

- Yield farming strategies – Yield farming encompasses combining strategies like liquidity provision on DEXs and lending, where users lock tokens for a set period to earn rewards in DeFi. It’s possible to create intricate yield farming plans involving multiple DeFi applications and spanning across different blockchain networks.

Types of DeFi Wallets

There are two types of DeFi crypto wallets:

- Software wallets, commonly referred to as hot wallets – these are the most widely used DeFi wallets. They can be obtained as browser extensions or free mobile apps for Android and iOS. It’s important to note that these wallets are always connected to the internet.

- Hardware wallets, also known as cold wallets – these wallets hold crypto funds offline. They can be connected to the internet in order to engage in DeFi activities, but are disconnected after the transaction are performed.

How Are DeFi Wallets Different from CeFi?

| DeFi Wallets | CeFi Wallets | |

|---|---|---|

| Custody | Non-custodial, giving users full control over their funds. | Managed by exchanges which hold user private keys, possibly exposing to hacker attacks. |

| Transactions | All transactions are conducted on-chain without intermediaries. | Exchanges may settle transactions in-house first, then on-chain, causing potential delays and risks. |

| Regulations | Do not require KYC and do not report to government authorities. | Require KYC verification and report to government entities. |

| Operations Supported | Supports only crypto transactions. | Connected to CeFi exchanges and may support fiat operations. |

| User Interface | Varies; some have user-friendly interfaces. | Generally more user-friendly due to centralized development. |

DeFi Wallet Benefits

| Description | |

|---|---|

| Access to DeFi | DeFi wallets allow users to access DeFi and Web3 apps, enabling them to trade, lend, and earn yield. |

| Self-custody | Users maintain full control over their assets and private keys. |

| Enhanced Security | Tokens in non-custodial wallets are protected from hackers, in contrast to CEX-stored funds. |

| Early Access to Tokens | Users can get early access to emerging tokens and Web3 projects launching on DEXs through IDOs. |

| Interoperability | Facilitates easy asset transfer between blockchains, e.g., Ethereum and BNB Chain. |

DeFi Wallet Risks

| Risk Type | Description | Preventive Measure |

|---|---|---|

| Scams | DeFi attracts beginners, making them vulnerable to phishing attacks and social engineering. | Avoid suspicious links and transactions. |

| Hacks | DeFi wallets connected to the internet can be exposed to hacking. | Implement all available security tools. |

| Private Key Loss | Losing the private key means losing access to tokens in the wallet. | Securely store the recovery phrase (seed phrase) upon setup. |

| Smart Contract Risk | dapps can have code loopholes leading to exploits. | Research thoroughly before purchasing tokens, especially new ones. |

Top DeFi Wallets Today

Here are a few popular DeFi wallets today:

- MetaMask

- tastycrypto

- Coinbase Wallet

- Trust Wallet

- Crypto.com DeFi Wallet

FAQs

Obtaining a DeFi wallet is straightforward. Simply download the DeFi wallet app or browser extension from their official websites.

Yes, DeFi wallets are safer than CeFi wallets because they are non-custodial, giving users full control over their funds. Hardware wallets are the safest option.

DeFi wallets are decentralized wallets that offer users special features related to decentralized finance.

You cannot directly convert your DeFi wallet holdings into cash. To access cash, you can transfer your tokens to a CeFi wallet, exchange them for fiat currency on a Centralized Exchange (CEX), and then proceed to withdraw your fiat funds

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences