Definition: Decentralized stablecoins are blockchain-based digital assets designed to have low volatility by pegging their price to separate asset classes (e.g., fiat currency). Unlike centralized stablecoins (e.g., USDT & USDC), decentralized stablecoins are managed by a community.

Written by: Anatol Antonovici | Updated August 5, 2024

Reviewed by: Mike Martin

Fact checked by: Ryan Grace

In 2024, stablecoins play a crucial role in the crypto and DeFi ecosystem. In order to mitigate the centralized risks inherent in centralized stablecoins like USDT and USDC, a truly decentralized stablecoin is needed in crypto. In this article, we’ll show you how these promising digital assets work.

🍒 tasty takeaways

Decentralized stablecoins are blockchain-based digital assets pegged to separate asset classes, managed by a decentralized community, and use algorithms and smart contracts for supply management.

They are transparent and resistant to censorship compared to centralized stablecoins like USDT and USDC.

- Decentralized stablecoins achieve stability through algorithms, smart contracts, and collateral (e.g., DAI) or algorithmic methods (e.g., AMPL).

What Is a Stablecoin?

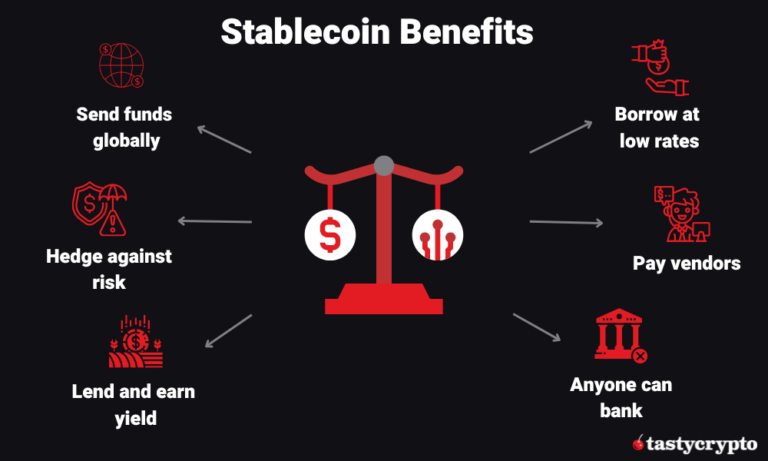

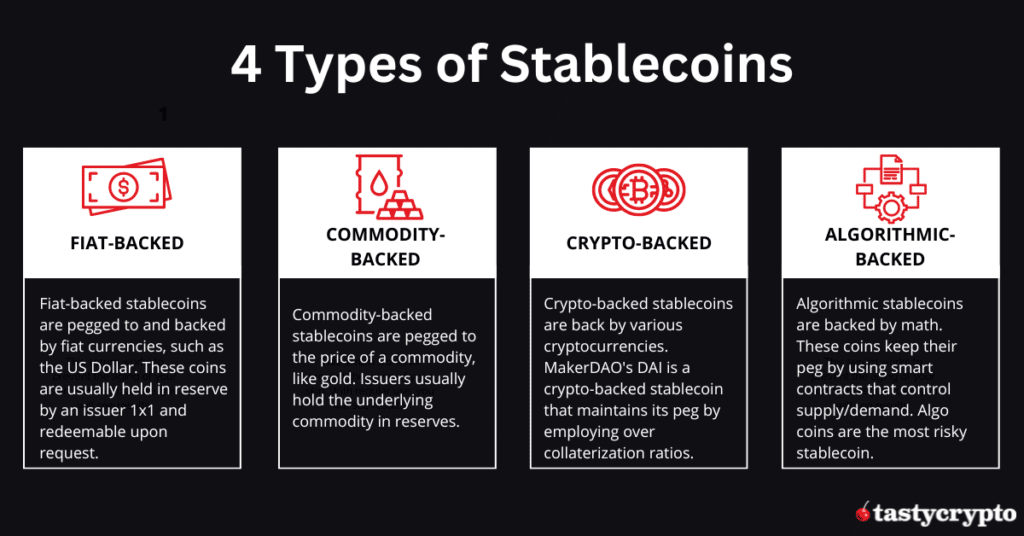

A stablecoin is a blockchain-based cryptocurrency that mirrors the value of a traditional financial (TradFi) asset, most commonly a fiat currency like the US dollar. Thanks to their price peg mechanism, stablecoins reduce volatility significantly, giving crypto market participants a liquid and safe instrument to store value and trade.

The primary goal of stablecoins is to mitigate extreme volatility, but they also open the door to many opportunities and use cases in the crypto space. For example, these tokens play a key role in the decentralized finance (DeFi) ecosystem, which comprises financial services built on community-driven Web3 applications.

Stablecoins merge the stability and liquidity of fiat currencies with the features of blockchain technology. These features include:

- Decentralization

- Transparency

- Security

- Speed

- Efficiency

While all stablecoins seek to achieve parity with their underlying asset, they employ very different approaches. Decentralized versions are one of the most popular and exciting types of stablecoins

What Are Decentralized Stablecoins?

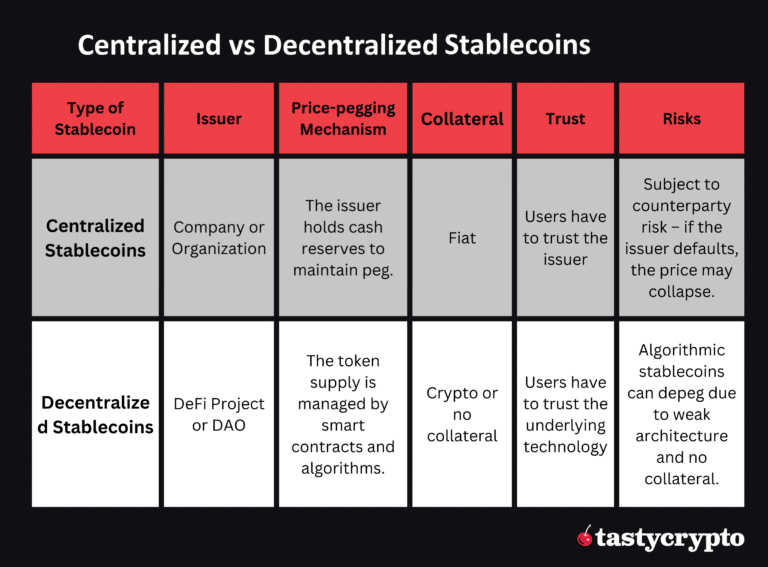

Decentralized stablecoins are tokens that mirror the price of an underlying asset without having to rely on a centralized entity, with all the rules being enforced by smart contracts and algorithms.

Unlike their centralized counterparts, which are backed by cash reserves managed by a single entity, decentralized stablecoins achieve price stability through automated algorithms or smart contracts on a blockchain. They are fully transparent and are non-custodial, meaning that there is no centralized entity controlling the reserves. Any collateral that backs a decentralized stablecoin is visible to users thanks to blockchain.

Decentralization enables a trustless and secure ecosystem that is independent of any external involvement or censorship. No single entity can tamper with the supply of the coin.

How Do Decentralized Stablecoins Work?

Decentralized stablecoins rely on algorithms and smart contracts to adjust the supply of the token in order to maintain a stable value. In a nutshell, if the price of the token increases, the system will create new tokens to meet demand, and when it drops below the peg, the system will burn the tokens to reach parity.

However, some decentralized stablecoins rely on some form of collateral – mainly involving crypto assets – while others don’t. For example, Ampleforth (AMPL) is a type of decentralized stablecoin that doesn’t use any form of collateral. It adjusts the token supply on a daily basis based on demand. Tokens like AMPL fall under the category of algorithmic stablecoins.

Maker DAO: DAI Decentralized Stablecoin

Elsewhere, MakerDAO’s DAI, the largest decentralized stablecoin by market cap, employs so-called collateral debt positions (CDPs) to back its token, enabling users to deposit crypto collateral in order to get (mint) DAI.

What makes DAI reliable compared to algorithmic counterparts is that it is overcollateralized, meaning that users have to lock a greater value than the sought DAI. If the price of the collateral drops below a certain limit, the collateral will be liquidated by ‘keepers’ in order to maintain price stability.

Decentralized vs. Centralized Stablecoins

The main difference between decentralized and centralized stablecoins is that decentralzied stablecoins don’t rely on any single entity to manage the supply and the minting of tokens.

The two largest stablecoins by market cap, Tether (USDT) and USD Coin (USDC) are managed by centralized organizations: Tether and Circle, respectively. PYUSD is A US Dollar-backed stablecoin issued by PayPal.

While both claim to be transparent, what keeps these tokens stable is people’s trust. In fact, USDT has been surrounded by controversy for years and was even penalized by the US Commodity and Futures Trading Commission (CFTC) for misstating its reserves.

With decentralized stablecoins, transparency is embedded into the code itself. Also, no one entity can control or censor these tokens, with all transactions and supply dynamics being verifiable at any time, thanks to blockchain.

Decentralized Stablecoin Risks

Decentralized stablecoins are a groundbreaking development, but they also carry inherent risks. If they didn’t, they would likely have surpassed centralized stablecoins in popularity and adoption. The primary risks are often linked to algorithmic stablecoins, whereas stablecoins collateralized by cryptocurrency, such as DAI, tend to be more secure.

Algorithmic stablecoins, despite using sophisticated algorithms, financial engineering, and incentives, are not reliable due to the lack of collateral.

In 2022, Terra USD (UST), once among the largest stablecoins by market cap with a value of over $18 billion, depegged and triggered the collapse of a $60 billion crypto ecosystem, setting an ugly precedent for algorithmic stablecoins.

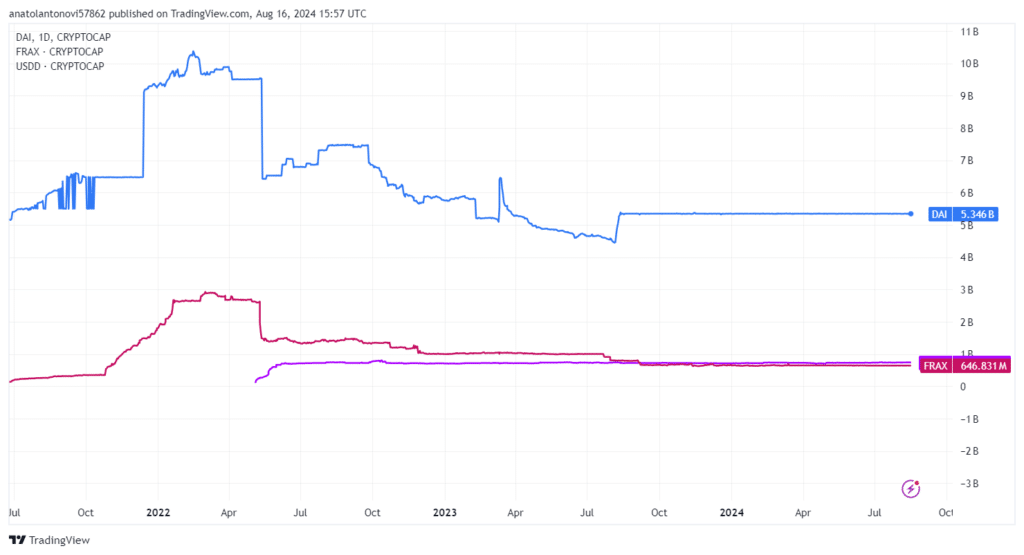

Examples of Decentralized Stablecoins

Here are some popular stablecoins that are decentralized and run on-chain:

- DAI – DAI is the most popular and reliable decentralized stablecoin. This Ethereum-based token is part of Maker, a DeFi lending protocol managed by a decentralized autonomous organization (DAO) known as MakerDAO. As mentioned, DAI uses over-collateralization to maintain its peg.

- USDD – This dollar-pegged digital currency is part of the Tron ecosystem. USDD is managed by a decentralized community of stakeholders who make decisions on behalf of the wider community via the TRON DAO Reserve (TDR).

- FRAX – Frax is the first fractional-algorithmic stablecoin, combining elements of collateral-backed supply and algorithmic supply.

Summary

Supply Management: Decentralized stablecoins use algorithms and smart contracts to manage their supply, eliminating the need for centralized entities.

Transparency and Resistance: Decentralized stablecoins are more transparent and resistant to censorship compared to their centralized counterparts. They are not reliant on cash reserves managed by single entities.

DAI as a Leading Example: DAI, a decentralized stablecoin, is one of the largest by market cap, and it achieves stability through overcollateralization and automated mechanisms.

Stablecoins Explained: Stablecoins are blockchain-based cryptocurrencies mirroring traditional financial assets, reducing crypto market volatility and serving various use cases, especially in decentralized finance (DeFi).

Features of Stablecoins: Stablecoins combine the stability and liquidity of fiat currencies with blockchain’s advantages like decentralization, transparency, security, speed, and efficiency.

Decentralized Stablecoins’ Mechanism: These tokens maintain price stability through smart contracts and algorithms, ensuring trustlessness and security.

Decentralized vs. Centralized Stablecoins: The main distinction is that decentralized stablecoins do not rely on single entities for supply management, while centralized stablecoins like USDT and USDC do.

Risks of Decentralized Stablecoins: Algorithmic stablecoins can be less reliable due to a lack of collateral, as seen in the Terra USD (UST) depegging incident in 2022.

Examples of Decentralized Stablecoins: Notable decentralized stablecoins include DAI, USDD (Tron ecosystem), and FRAX (fractional-algorithmic stablecoin). Maker’s DAI is often considered the most reliable. You can acquire decentralized stablecoins through exchanges, and they are generally safe, especially when collateralized. Algorithmic stablecoins carry more risks.

FAQs

As of today, Maker’s DAI is regarded as the most reliable stablecoin. It has been around for years and is overcollateralized, meaning that the value of crypto funds backing the peg is higher than the value of DAI’s circulating supply.

Anyone can easily purchase decentralized stablecoins via centralized or decentralized exchanges (DEXs). To buy stablecoins on a DEX, you will need a decentralized crypto wallet, like tastycrypto. Additionally, you can obtain DAI through the Maker protocol by depositing crypto collateral (usually in the form of ether ETH).

The supply and other components of decentralized stablecoins are managed by communities in a decentralized manner. Centralized stablecoins are issued and maintained by companies.

Decentralized stablecoins are generally safe, especially those relying on crypto collateral. Algorithmic stablecoins, however, pose significant risks.

Anatol Antonovici

6+ years of experience writing for crypto brands and blockchain firms, including Coindesk, Cointelegraph, Bitcoinist, CryptoPotato, Algorand, and OTCTrade.com

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences