Bitcoin and Ethereum are the least volatile cryptocurrencies. Litecoin and Bitcoin Cash have high volatility and relatively low adoption.

Written by: Mike Martin | Updated September 5, 2024

Reviewed by: Ryan Grace

Fact checked by: Laurence Willows

In June of 2023, the SEC cracked down on what coins and tokens cryptocurrency exchanges can offer their customers. To mitigate risk, exchanges like EDX Markets are limiting their exposure to four coins.

In this article, we’ll compare the four coins left standing on most centralized exchanges: bitcoin (BTC), bitcoin cash (BCH), ether (ETH), and litecoin (LTC).

🍒 tasty takeaways

Bitcoin (BTC) is both the largest and oldest crypto in existence.

Ethereum, or ether (ETH), is the second largest blockchain. This network can also store code.

Bitcoin Cash (BCH) was the product of a Bitcoin hard fork; BCH is faster than Bitcoin

Litecoin (LTC) has benefited from being an early blockchain (created in 2011).

Bitcoin and ether are widely considered the best crypto investments.

Summary

| Cryptocurrency | Rank | Market Cap | Created | Vision |

|---|---|---|---|---|

| Bitcoin (BTC) | 1st | $600 billion | 2009 | Decentralized digital currency without a central bank |

| Bitcoin Cash (BCH) | 15th | $5 billion | 2017 | Bitcoin with lower fees and faster confirmations |

| Ethereum (ETH) | 2nd | $225 billion | 2015 | Blockchain to store smart contracts |

| Litecoin (LTC) | 11th | $6 billion | 2011 | Faster block confirmations than Bitcoin |

| Ethereum vs Bitcoin | - | - | - | Ethereum has more use cases and is less expensive to transact |

| Bitcoin Cash vs Bitcoin | - | - | - | Bitcoin Cash has lower fees and faster confirmations |

| Litecoin vs Bitcoin | - | - | - | Litecoin offers faster transaction speeds and cheaper fees |

Bitcoin vs Bitcoin Cash vs Ethereum vs Litecoin

In regards to crypto market cap rank, here are where our 4 coins stand:

#1. Bitcoin

#2. Ether

#14. Bitcoin Cash

#18. Litecoin

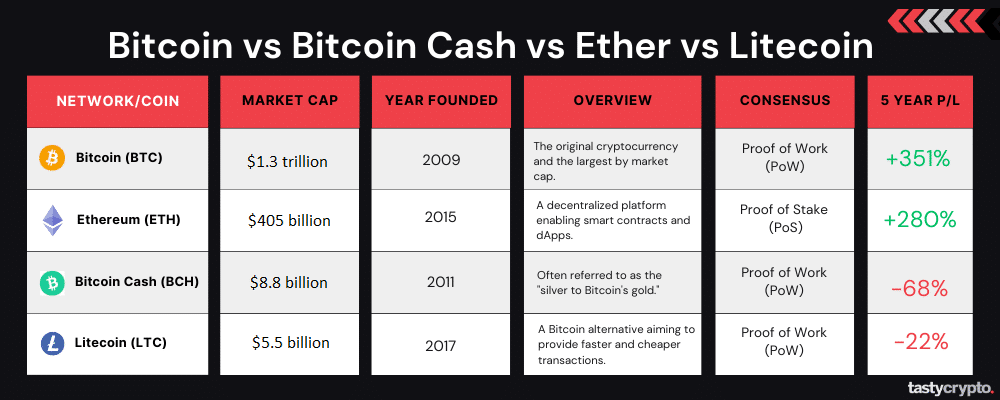

Before we dive into comparing our coins individually, let’s look at an overview of each blockchain’s characteristics:

What Is Bitcoin (BTC)?

Network: Bitcoin

Coin: bitcoin (BTC)

Rank: 1st

Market Cap: $1.37 trillion

Created: 2009

Max Supply: 21 million BTC

Founder: Satoshi Nakamoto (pseudonym)

Vision: Decentralized digital currency without a central bank

The Bitcoin network, launched in 2009 by an anonymous creator known as ‘Satoshi Nakamoto’, is both the oldest and largest blockchain network in existence.

Bitcoin’s native currency is ‘bitcoin’ (BTC), which is a cryptocurrency. Cryptocurrencies are digital assets that are secured and verified with cryptography. In order to understand how cryptocurrency truly works, it will help to have an elementary understanding of how peer-to-peer decentralized blockchain technology works.

📖 Read: Bitcoin Whitepaper

How Does Bitcoin Work?

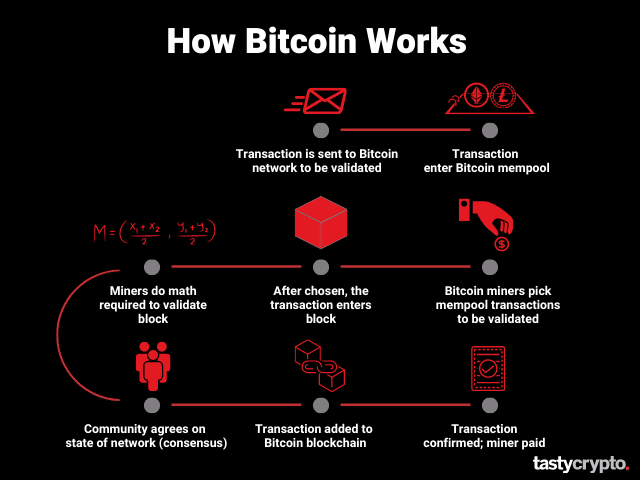

All bitcoins (BTC) are created through the Bitcoin network’s consensus mechanism, which is called proof-of-work (PoW).

In PoW networks, transactions are added to the Bitcoin blockchain by Bitcoin miners.

Before transactions can be added to a blockchain, they must first be verified and validated by a Bitcoin miner. Miners are rewarded in bitcoin, which these participants, in turn, sell to exchanges, and ultimately to us.

💡 Bitcoin the blockchain is spelled with a capital ‘B’ while bitcoin the cryptocurrency is spelled with a lowercase ‘b’.

Should I Invest in Bitcoin?

If you want to add cryptocurrency to your investment portfolio, bitcoin (BTC) is a must. This cryptocurrency has a ‘market dominance’ of over 50%, which means that the market cap of BTC represents 50% of the entire crypto market, which numbers in the thousands.

The current market cap of bitcoin is about $1.3 trillion. The next largest coin is ether (ETH), which has a market cap of $405 billion.

Bitcoin is also the least volatile cryptocurrency (not counting pegged stablecoins). Having bitcoin in your crypto portfolio will therefore help to reduce overall volatility.

Additionally, there will only ever be 21 million bitcoins in existence. This makes bitcoin a deflationary asset. Deflationary assets, because of scarcity, tend to rise in value over time. Bitcoin also acts as a great hedge against poor monetary policies, which debase the value of fiat currency when central banks printing money.

🍒 Compare two other crypto heavyweights here! Cardano vs Solana

What Is Bitcoin Cash (BCH)?

Network: Bitcoin Cash

Coin: bitcoin cash (BCH)

Rank: 15th

Market Cap: $8.8 billion

Created: 2017

Max Supply: 21 million BCH

Vision: Bitcoin with lower fees and faster confirmations

Bitcoin Cash is the open-source digital currency that was created when the Bitcoin network ‘hard forked’ in 2017.

In blockchains, hard forks are the result of disagreement within a community. When all parties can’t agree on an outcome, the blockchain sometimes diverges and a new blockchain begins.

Proponents of Bitcoin Cash argued that greater scalability and transaction speed would be in the network’s best interest. However, the majority disagreed with these plans as they believed this would lead to reduced decentralization of the network.

Therefore, the network forked and Bitcoin Cash (BCH) was created.

How Does Bitcoin Cash Work?

The main difference between Bitcoin and Bitcoin Cash is that Bitcoin Cash has a large block size of 32 MB. Compare this to Bitcoin, which only has a block size of 1 MB. This allows Bitcoin Cash to handle more transactions and validate transactions faster than the original network.

Like Bitcoin, Bitcoin Cash uses the PoW consensus mechanism. This network, however, has a much smaller community and following than the Bitcoin network.

Should I Invest in Bitcoin Cash?

Bitcoin Cash is an ‘altcoin’. Alt (alternative) coins are defined as any cryptocurrency (coin or token) that is not bitcoin.

According to CoinMarketCap, Bitcoin Cash is the 14th largest cryptocurrency by market cap. Bitcoin Cash’s market cap of $8.8 billion pales in comparison to Bitcoin, which is about 140x bigger with a whopping market cap of $1.3 trillion.

In 2024, however, Bitcoin Cash has almost doubled in value. This is because the SEC does not deem proof-of-work coins securities.

Bitcoin Cash, therefore, maybe a decent investment for the future as it is (for now) deemed a ‘non-security’ by the SEC.

I would, however, recommend purchasing ether (ETH) before Bitcoin Cash. Let’s explore ether next!

What Is Ethereum (ETH)

Network: Ethereum

Coin: ether (ETH)

Rank: 2nd

Market Cap: $405 billion

Created: 2015

Max Supply: Infinite (now deflationary)

Founder: Vitalik Buterin

Vision: Blockchain to store smart contracts

Ether is the native cryptocurrency of the Ethereum blockchain, which is the second largest blockchain by market capitalization in existence after Bitcoin.

Vitalik Buterin believed that a blockchain could do more than simply store transactions (bitcoin). He envisioned a blockchain network that could store both transactions and execute code. This high-functionality blockchain was his vision for Ethereum, which was launched in 2015.

📖 Read: Ethereum Whitepaper

How Does Ethereum Work?

Unlike Bitcoin and Bitcoin Cash, Ethereum is now a proof-of-stake (PoS) blockchain.

In PoS blockchains, ‘validators’ are chosen to add new blocks to a blockchain. This is in contrast to PoW, which involves thousands of miners from all over the world competing to solve an algorithm.

In order to be chosen as an Ethereum validator, you need to stake ether. The network chooses the computer (node) of a staked coin at random in order to do the math required to validate a block. Choosing a validator, as opposed to having them compete, reduces energy dramatically. The Ethereum validation process use ~99% less energy than Bitcoin mining.

In 2025, Ethereum introduce sharding, which will dramatically increase transaction throughput and lower network fees.

Ethereum and Web3

Ethereum is the predominant blockchain behind Web3. We mentioned before that Ethereum could store and execute code. This code is stored and executed on the Ethereum blockchain via smart contracts.

Smart contracts are the lifeblood of the decentralized applications (dApps) that are creating Web3. In Web3, processes are automated by these smart contracts. This is in contrast to the Web2 applications we use today (Twitter, Facebook, etc).

Instead of data being stored on a centralized server (Web2), in Web3 this data is distributed across every participant of the blockchain.

Decentralized finance (DeFi) is the term given to all dApps that operate in the finance space. DeFi is revolutionizing finance. There are decentralized exchanges (DEXs), decentralized borrowing and lending platforms, and decentralized staking platforms, all run by a community rather than a corporation!

📖 Read: 7 Ways To Invest in Web3 in 2023

Ethereum is also the only coin on our list that can support NFTs (non-fungible tokens).

Should I Invest in Ethereum?

Ethereum (ether) is the second most-held digital asset after bitcoin. Unlike Bitcoin Cash and Litecoin, ether is a must-have for any crypto portfolio. As we learned above, Ethereum has far more use cases than most cryptos, which mainly act as a store of value.

Since Ethereum is a PoS blockchain, you can also earn interest on your ether by staking it! This is impossible with PoW coins, which constitute the other three coins on our list. You can stake ether on both centralized exchanges and through decentralized protocols like Lido and RocketPool.

Additionally, it is typically less expensive to transact on the Ethereum network than bitcoin. On Ethereum, these network fees are called gas fees.

📖 Read: 5 Best Ways to Stake Ethereum

What is Litecoin (LTC)?

Network: Litecoin

Coin: litecoin (LTC)

Rank: 18th

Market Cap: $5.5 billion

Created: 2011

Max Supply: 84 million LTC

Founder: Charlie Lee

Vision: Faster block confirmations than Bitcoin

Litecoin is a decentralized, open-sourced blockchain network created in 2011 by Charlie Lee.

Litecoin is often referred to as the “silver to Bitcoin’s gold” because of its similarities to the Bitcoin network. However, the codebase for Litecoin has been modified to allow for faster transaction speeds and cheaper network/transaction fees than Bitcoin.

How Does Litecoin Work?

Like Bitcoin, the Litecoin network relies on the proof-of-work consensus mechanism.

In this model, transactions are broadcasted to the Litecoin network. These transactions wait in a ‘mempool’ until a miner picks them up and adds them to a block. The higher the fee attached to an order, the faster a Litecoin miner picks up a transaction to be validated and confirmed in a crypto wallet.

Another distinguishing feature of Litecoin is this blockchain uses a hashing algorithm called ‘scrypt’. Most other proof-of-work blockchains use the traditional SHA-256 algorithm. Scrypt makes it more difficult for ASIC miners to gain an advantage over CPU miners.

Like Bitcoin and Bitcoin Cash, the blocks within Litecoin are only able to store transactions.

Should I Invest in Litecoin?

In the early days of blockchain, there were only a handful of cryptocurrencies in existence. Litecoin was one of the first cryptos to come into existence. Because of this, LTC had a first mover advantage.

However, many more blockchains have launched since Litecoin’s debut in 2011.

Today, Litecoin is the 18th most popular cryptocurrency in existence with a market cap of $5.5 billion. All of the following coins rank above Litecoin in July of 2024:

Bitcoin

Ethereum

Tether (stablecoin)

BNB (BNB)

USD Coin (USDC)

XRP (XRP)

Cardano (ADA)

Dogecoin (DOGE)

Solana (SOL)

Tron (TRON)

Polkadot (DOT)

Litecoin (LTC)

Like Bitcoin Cash, Litecoin has a much smaller market cap than Bitcoin ($5.5 billion vs $1.3 trillion).

Unlike Bitcoin Cash, however, Litecoin (which is not deemed a security by the SEC) has essentially not moved in value since Gary Gensler dropped the hammer on crypto and the subsequent launch of EDX Markets.

Litecoin doesn’t have much utility other than a store of value. Personally, I would invest in coins with utility, such as the layer-2 scaling solution Polygon (MATIC), before I invested in Litecoin.

📖 Read: Arbitrum (ARB) vs Optimism (OP) vs Polygon (MATIC): Which is Best?

BTC vs ETH vs LTE vs ETH: Which to Buy?

The first cryptocurrency purchase most investors make is bitcoin. The second coin the majority of investors choose for their investment portfolio is ether, the native token of Ethereum.

These two are the big players in crypto. If you choose to invest in Bitcoin Cash or Litecoin, you will likely experience elevated volatility.

Additionally, over the last five years, both Bitcoin Cash and Litecoin have been losing investments while bitcoin and ether have been winning investments (100%+).

At the end of the day, if blockchain does indeed grow, the Bitcoin and Ethereum networks will likely be the drivers of this growth.

BTC, BCH, LTE & ETH: Where Can I Buy Them?

There are two primary ways to buy cryptocurrency: on centralized exchanges and decentralized exchanges:

Popular centralized exchanges (CEXs) to buy LTC, BCH, ETH, and BTC include Binance, Coinbase, and tastytrade.

Popular decentralized exchanges, or ‘DEXs’, include Uniswap and 1inch.

In order to buy crypto on a DEX, you’ll need a self-custody crypto wallet, like the ones that tastycrypto offers!

Unlike CEXs, which typically only offer a handful of coins, DEXs offer thousands of cryptocurrencies.

Here’s a list of 11 popular DeFi coins to get you started.

FAQs

Bitcoin Cash is generally not a better investment than bitcoin. The market cap of bitcoin cash is a fraction of bitcoin’s. Additionally, Bitcoin Cash does not have the large community that the Bitcoin network has.

Bitcoin cash has a higher transaction throughput than Bitcoin. Additionally, Bitcoin Cash has lower network fees than Bitcoin.

Bitcoin Cash is a risky investment. This is because Bitcoin Cash (BCH) experiences high market volatility. Additionally, Bitcoin Cash has low adoption rates. This could hinder its growth.

Bitcoin Cash will likely not ever overtake Bitcoin. The Bitcoin network is simply too large.

Ethereum is generally considered a better investment than Litecoin. This is because the Ethereum blockchain can store smart contracts, which are the driving force behind Web3.

Litecoin is a proof-of-work blockchain that mainly acts as a store of value; Ethereum is a proof-of-stake blockchain that offers more utility. Additionally, the market cap of ether is significantly larger than Litecoin.

Litecoin has advantages over Bitcoin in regard to network fees and transaction throughput. However, if you don’t plan on actually transacting with cryptocurrency, Litecoin is generally considered a subpar crypto when compared to Bitcoin.

Additional Reading

Litecoin vs. Bitcoin vs. Ethereum: What are the Differences?

Mike Martin

Mike Martin formerly served as the Head of Content for tastycrypto. Before joining tastycrypto, Michael worked in the active trader divisions of thinkorswim, TD Ameritrade, and Charles Schwab. He also served as a writer and editor for projectfinance.

Michael has been active in the crypto community since 2017. He holds certifications from Duke University in decentralized finance (DeFi) and blockchain technology.

🍒 tasty reads

The Core Blockchain and DeFi Ecosystem: What You Need to Know

7 Best DePIN Crypto Projects

What Is Symbiotic and How Does It Work in 2024?

Ethereum vs Ethereum ETFs – 5 Major Differences